Building wealth is a goal that many people aspire to achieve, and it often involves hard work, dedication, and smart financial decisions. However, what many people fail to realize is that building wealth is also tied to self-love and prioritizing yourself.

In a recent Twitter Space hosted by Adora and co-hosted by Adesuwa from Accrue, Adora Nwodo (@AdoraNwodo) shared her perspective on the connection between self-love and wealth-building.

What’s your opinion on Self-love being a requirement for building wealth?

Personally, I believe that self-love is essential to building wealth. There may be other reasons why one wants to accumulate wealth, such as providing for their family’s future. However, for me, building wealth is about achieving my personal goals and taking care of my own well-being. It is tied to self-love because I want to pursue my interests and reach my financial objectives.

For instance, I have openly shared my desire to take a one-year sabbatical and travel to the Middle East, Europe, and Northern Africa to learn about the history of religion and the world. This requires a substantial amount of money and time, but it is something I am willing to invest in because I value my personal growth and development. Taking a break from work and life is a form of self-love, and having the financial security to afford it is crucial.

In my opinion, self-love is a prerequisite for building wealth because it motivates you to seek out the best opportunities and experiences that life has to offer. By loving yourself, you recognize your worth and the importance of investing in your future. It’s not just about accumulating wealth for the sake of it but using it as a tool to enhance your life and achieve your goals.

How has self-love led you to prioritize wealth-building?

I think the main thing in my life, as anyone close to me would know, is that even though people might assume I don’t get enough sleep or stress myself out, I’m actually a very lazy person. I’m probably the laziest hard worker you’ll ever meet.

What this means is that I don’t like people, situations, or anything that stresses me out. I also apply this idea to the jobs I decide to take and the places I choose to invest my money. I won’t put my money in a place that will give me a heart attack, nor will I take a job that stresses me out, even if it pays a lot.

In terms of my personal journey of learning to love myself, prioritizing wealth-building has been essential. I usually prioritize my sanity above everything else, and that has worked well for me. However, other people may have different approaches, especially those dealing with black tax or other circumstances. My salary is my own, and because of that, I can only invest my time in jobs or money-making ventures that add value to me and don’t stress me out. I think about loving myself through the whole process while making sure I’m getting value for my work or whatever space I’m investing myself in. It has worked out nicely for me, but for others, this may not be the case, especially if they’re the breadwinner.

What advice would you give somebody who doesn’t share your reality of owning 100% of their salary?

I’ve had friends who have shared their experiences with black taxes. I usually say, “In this life, if you died today, your family members who want to take advantage of you for financial gain would find someone else to exploit.” However, I don’t mean this to discourage you from supporting them. Instead, I think it’s important to establish boundaries. If you allow them to take advantage of you, they will keep asking. Sometimes, they may not even realize that they are burdening you. They might assume that you have enough to spare, and as long as they keep asking or you keep giving, everything is okay.

It’s important to acknowledge that some family members can be toxic, but often, they might just be unaware of how their actions affect you. You don’t have to play the role of the Messiah and try to save them. Instead, communicate your boundaries. At the end of the day, people who truly matter will understand.

It’s okay to cut off toxic family members. If anyone feels ashamed because you have communicated your limits, you can establish a budget. Some people even set up their family members to become financially independent so that they can focus on their own lives.

Find a way to set boundaries and communicate them clearly. This will create balance, and everyone can focus on their own lives. However, it can be challenging, especially when it comes to black tax. The small black tax, like helping with school fees, is not the issue. It’s the “big black tax,” like paying for someone’s master’s degree, that can be a problem.

It’s okay to disappoint your family members early and set boundaries. They may look at you strangely because you have the means to help them, but it’s better for everyone in the long run. It’s important to prioritize your own life and future.

How does one shift their mindset from a place of self-doubt to being optimistic?

It’s always important to have a growth mindset and be optimistic. 2022 was difficult for many people, for various reasons. 2020 was also challenging for many people. We don’t know what 2023 will bring, as it’s still early in the year. It’s only the second week of the second month, and we have ten more months to go. A lot can change in just one month.

Firstly, it’s not just a self-love mindset; it’s an abundance mindset. People need to switch from a scarcity mentality to one of abundance. This means that if you face financial challenges or lose your job, it’s a setback. You have to know a better job with more opportunities will come up. Meanwhile, be happy that you have saved some money and have some months of runway. You can cut down on expenses, move back home, or stay with a friend to sustain yourself. You need to remain optimistic about the year and keep looking for opportunities. You can take any job to generate income and later move into a better one when the market stabilizes.

It’s hard to maintain an optimistic mindset when everything is falling apart around you. People are losing their jobs, and the competition for the few remaining jobs is high. However, it’s the best thing you can do for yourself. You need to prioritize yourself financially, maintain positivity and logic, and plan accordingly. Be ready to take opportunities when they come, because they will come. The market is changing, and there will be a shift in priorities and job roles. Companies have laid off employees, but new roles will arise, leading to readjustment.

It’s crucial to maintain optimism, even in the face of challenges. It’s not the end of the world, and if you’re logical and optimistic, there may be a light at the end of the tunnel.

For people looking to level up to make more money, how would you advise them?

Recently, I watched a video where ChatGPT was asked about the future of jobs, and the responses shared included data science, cloud engineering, and artificial intelligence. However, many people are not talking about the opportunities in the creator’s economy. I believe that if you are unemployed or have limited opportunities, now is the perfect time to create something with your hands, as there is a large community waiting to consume your content or products.

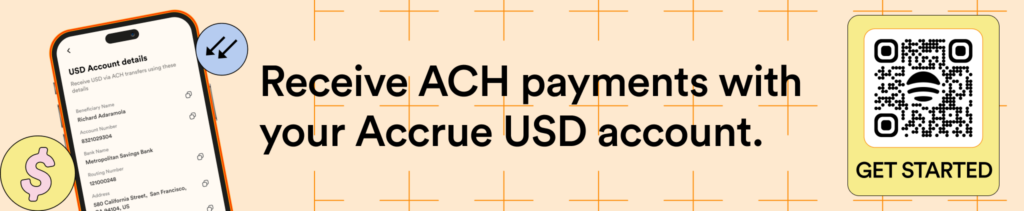

If you are creative, I suggest making it a side hustle. Look around you and identify immediate problems that you can solve, and then try to solve them. For those who do not have time to create or solve problems, you can invest your money in apps like Accrue to generate additional income. The best part is that, with everyone online, you are no longer location-bound. You can offer value as a freelancer or digital creator, such as a YouTuber, TikToker, or podcaster, and make money while having fun.

I cannot tell you what is currently in demand because everyone would want to do it, and it would become saturated. Instead, look within your immediate community, identify a problem, create a solution, monetize it, and make a lot of money. You will be surprised by the results.

How would you say that people can balance self-love and self-care, while building wealth?

Self-care doesn’t have to be expensive, so it’s important to live within your means. If you can’t afford to go to the spa, don’t go if it will cause financial strain. There are other things you can do, such as listening to relaxing music or taking long baths or showers.

Even something as simple as lighting scented candles or watching TV can help you relax. The most important thing is to make sure your brain is in a good state all the time. If you can’t afford to go out, consider having video calls with loved ones or blocking time in your calendar for rest and relaxation. It’s important to know your financial capacity and plan around it. Not everyone needs to go to the spa multiple times a year, and there are many other ways to practice self-care that are more affordable.

Yeah, that makes a lot of sense, just like living within your means and finding more affordable ways to enjoy self-care. How would you advise people to position themselves for opportunities that will lead them to build wealth?

I will just say, be ready, because being ready is crucial, as it depends on what the market is saying. Be ready to evolve yourself, and make sure that you are easily found. If I were to search for senior data scientists in Lagos on LinkedIn, would I be able to find you?

When I talk about putting yourself out there, I do not mean that you should build a public brand if you are uncomfortable with it. However, it is important to be present on platforms where recruiters go to find talent. Optimizing your LinkedIn profile can increase your chances of being found by recruiters. If you are positioning yourself for data scientist roles, it is important to keep up with market trends and position yourself to be found. When things open up again, there will be a surge in hiring, and generative AI will bring new job opportunities. It is important to be ready for these new roles by positioning yourself to be found by recruiters.

We talk a lot about building wealth, but sustaining wealth is a more difficult job. For example, how some families blow generational wealth in a flash. How would you say that we stay up that ladder and actually sustain the wealth of our building?

One thing I would say I know about people who have successfully built generational wealth is that they do two things: invest and start businesses. Many of these families have some kind of family business or company that has become a legacy or dynasty, even if it’s not solely run by the family anymore. Additionally, if you look closely, you’ll often find that the parents of these families are also seated on the boards of other major companies, providing them with advisory roles and additional sources of income.

These are the two main factors I have observed in successful generational wealth building. There may be other deeper secrets, but I don’t know them yet. If you ask me this question again in the future, perhaps I’ll have a better answer for you.

Send and receive money across Africa and the US with ease!