Budgeting is one of the most fundamental steps to achieving financial stability. It gives you control over your money, helps you avoid unnecessary debt, and ensures you’re steadily working toward your goals. Among the many budgeting techniques available, the 50/30/20 rule has gained popularity for its simplicity and flexibility. But how practical is this rule, especially for Africans navigating unique economic conditions and cross-border financial obligations?

What is the 50/30/20 rule?

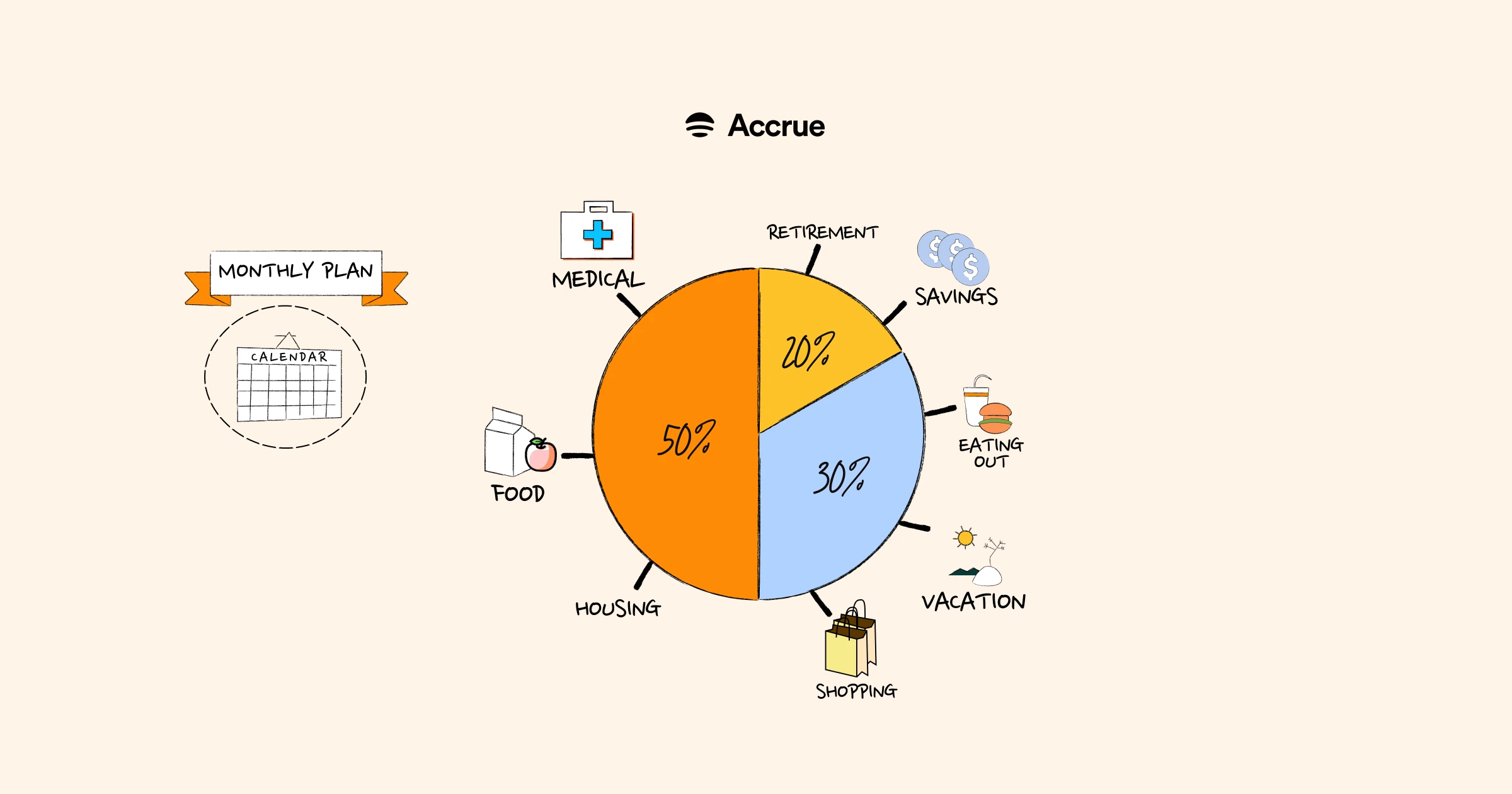

The 50/30/20 rule is a simple budgeting framework that helps individuals manage their income by dividing it into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. Needs include essential expenses; wants cover optional spending such as entertainment and non-essential purchases. The final 20% is allocated to financial growth, including savings, investments, emergency funds, or paying off loans. This rule provides a clear, easy-to-follow structure for achieving financial balance and long-term stability.

50% – Needs:

These are essential living expenses — things you cannot live without. They include:

- Rent payments

- Utility bills (electricity, water, internet)

- Food and groceries

- Transportation costs (fuel, public transport, or car maintenance)

- Insurance and healthcare

30% – Wants:

These are lifestyle choices that enhance your quality of life but are not strictly necessary. They include:

- Dining out and entertainment

- Shopping for non-essential items (clothes, gadgets)

- Vacations or leisure activities

- Subscriptions (Netflix, Spotify, etc.)

20% – Savings and debt repayment:

This category focuses on securing your future and includes:

- Building an emergency fund

- Contributions to savings accounts or investment platforms like Accrue

- Retirement savings

- Paying back loans or debt

Why the 50/30/20 rule works

The strength of this rule lies in its simplicity. It doesn’t require tracking every single expense down to the last cent. Instead, it groups your spending into broad categories, which makes it easier to follow consistently. It also provides room for you to cater to your needs and build wealth while enjoying the things you want, too.

Some key benefits of the 50/30/20 rule approach

Simplicity and clarity

The 50/30/20 rule is easy to understand and apply, even for beginners. By dividing your income into just three categories — needs, wants, and savings — it eliminates the confusion of tracking every small expense, making budgeting less overwhelming and more practical.

Encourages consistent saving

One of the strongest advantages of this rule is that it prioritizes saving and debt repayment. By dedicating 20% of your income to financial growth, you steadily build an emergency fund, reduce debt, and work toward long-term goals without sacrificing essential needs.

Promotes financial balance

This approach helps you find a healthy balance between enjoying your income now and planning for the future. It ensures that while you cover your necessities and save, you also have room to spend on non-essentials that enhance your quality of life.

Adaptable to different income levels

Whether you’re earning a modest salary or a high income, the 50/30/20 rule can be tailored to fit your financial situation. It offers a flexible framework that can be adjusted as your income grows, making it a sustainable long-term budgeting strategy.

Challenges of applying the 50/30/20 rule

While the rule is effective in theory, applying it in real-life situations can be tricky:

Rising cost of living

In many places, essentials like rent, food, and transportation can easily consume more than 50% of a person’s income. This makes it difficult to stick to the rule without compromising on needs or reducing savings.

Irregular or unstable income

For freelancers, gig workers, and individuals earning from informal sectors, income may not be consistent. This unpredictability makes it challenging to allocate fixed percentages each month and requires constant adjustments.

High debt obligations

If a significant portion of your income is dedicated to repaying loans, the recommended 20% for savings and debt repayment may not be enough. Some people may need to prioritize debt repayment over wants and even reduce savings temporarily.

Family obligations

For many Africans, financial responsibilities often extend beyond personal needs to black tax, which includes supporting relatives, paying school fees, or contributing to community events. These obligations can stretch the “needs” category, leaving little room for wants or savings.

How to make the 50/30/20 rule work for you

Instead of abandoning the rule altogether, you can adjust the percentages to better fit your financial reality. Here are some tips:

- Track your current spending: Use financial tools, spreadsheets, or apps like Accrue to monitor where your money is going each month.

- Adjust the ratios: If your needs take up 60% of your income, reduce your wants to 20% and keep savings at 20%. The key is to always prioritize savings, even if it’s just 10% to start with.

- Automate savings: Set up automatic transfers to your savings account or investment plan each month to ensure you’re consistently building wealth.

- Set clear goals: Saving just to save can feel unmotivating. Instead, create tangible goals, e.g., a new apartment, a business venture, travel fund, or an emergency fund.

- Plan for black tax: If you regularly support family or relatives, factor black tax into your “needs” category. Set a fixed monthly amount for these obligations to avoid overspending, and adjust your wants or savings accordingly while still prioritizing consistency in saving.

- Focus on increasing income: If your needs are too high relative to your income, the most effective solution is to grow your earnings. Freelancing, side hustles, or cross-border opportunities can help.

Is it practical for Africans?

The 50/30/20 rule can be practical for Africans when viewed as a flexible guide rather than a rigid formula. Black tax, wide income disparities, unpredictable earnings from mixed-income sources, and periods of inflation or currency volatility further complicate the fixed-percentage budgeting. In this scenario, it makes sense to treat the rule as a starting framework. Its true value lies in encouraging intentional spending and consistent saving, no matter the income level. By adjusting the percentages to suit personal realities, such as expanding the “needs” category slightly or reducing “wants”, Africans can still maintain a balance between essential expenses, lifestyle choices, and financial growth. The key is to treat the rule as a foundation: automate savings (even if less than 20% initially), use the framework to track spending habits, and gradually increase savings as income grows. When applied with this adaptable mindset, the 50/30/20 rule remains a great tool for building financial stability and long-term wealth.

Who should use the 50/30/20 rule?

This rule is ideal for:

- Young professionals learning to manage their first income.

- Families looking for a simple budgeting system.

- Freelancers and creators who need a starting point for dividing their income.

- Anyone who struggles to save consistently.

Even if your expenses don’t perfectly match the percentages, the principle of prioritizing needs, limiting wants, and saving for the future remains universally useful.

Final thoughts

The 50/30/20 rule isn’t a one-size-fits-all solution, but it provides a solid foundation for building healthy financial habits. For Africans, especially those managing cross-border finances or sending money home, adapting the rule to personal circumstances is important. Whether your split is 60/20/20 or 50/25/25, the important thing is to stay intentional with your money and ensure savings and investments remain a priority. Make the rule your own and make it work for you.

Start saving smarter today with Accrue, and make your money work for your future.

MORE FROM ACCRUE

How To Save In Dollars on Accrue

How You Can Build Wealth from $100/Month

How to Make Money From Your Hobbies