Artificial Intelligence (AI) is transforming industries worldwide, and personal finance is no exception. From budgeting and savings to investments and loans, AI-powered tools are making financial management easier, smarter, and more efficient. In Africa, where financial literacy levels vary and access to traditional banking services is often limited, AI is playing a crucial role in bridging the gap and empowering individuals to take control of their finances.

In this article, we’ll explore how AI is reshaping personal finance in Africa, making it more accessible, automated, and efficient.

1. AI-Powered Budgeting and Expense Tracking

Keeping track of expenses manually can be tedious and overwhelming. Many Africans struggle with financial discipline simply because they do not have a structured way of managing their income and expenses.

How AI Helps with Budgeting:

- Automated Expense Categorization: AI-powered apps analyze transactions and categorize them into food, transportation, entertainment, rent, etc., helping users understand where their money is going.

- Spending Insights and Alerts: AI detects unusual spending patterns and sends notifications when expenses exceed budgeted limits.

- Predictive Budgeting: AI can forecast future expenses based on past spending behavior, helping users plan better.

Imagine a young professional in Nairobi who frequently eats out but doesn’t realize how much it affects their finances. An AI-powered app analyzes their spending and alerts them that they spend KES 20,000 monthly on restaurants alone. With this insight, they can adjust their budget and start cooking at home more often, saving money in the process.

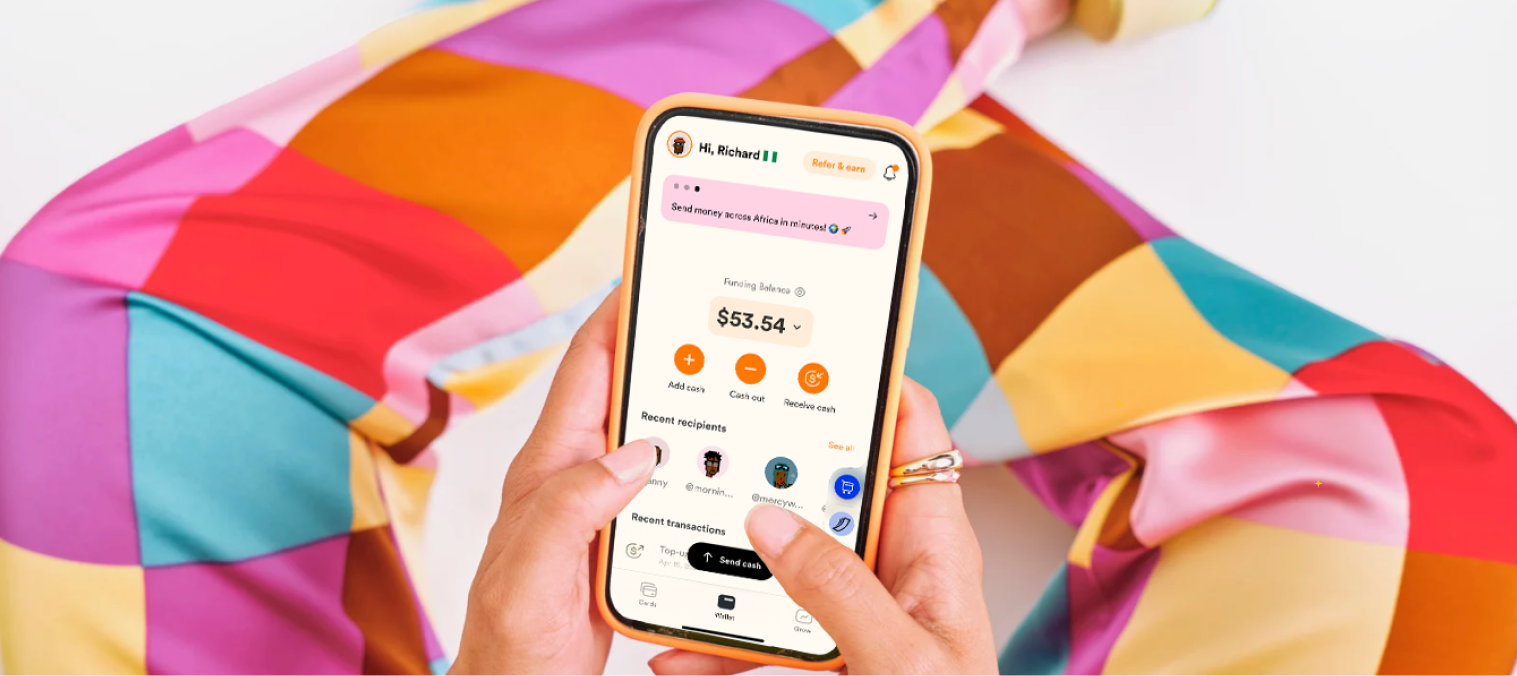

2. AI in Savings and Automated Investing

Many people struggle with saving money consistently due to poor spending habits and a lack of financial discipline. AI-powered savings platforms help individuals save automatically without thinking too much about it.

AI-Driven Savings Solutions:

- Round-Up Savings: Some apps automatically round up every transaction to the nearest currency unit and save the difference.

- Goal-Based Savings: Users can set financial goals (e.g., buying a car, paying school fees), and AI helps allocate savings accordingly.

- Automated Lock-Saving Plans: AI ensures that funds are locked away for a set period, reducing impulsive spending.

Investment Made Easy

Traditionally, investing required extensive financial knowledge, but AI has made it accessible to everyone. AI-powered robo-advisors analyze market trends and recommend the best investment options, whether in mutual funds, stocks, government bonds, or real estate.

Example: A small business owner in Johannesburg wants to invest in US stocks but has no experience. Instead of hiring an expensive financial advisor, they use an AI-driven investment app that suggests a portfolio based on their risk appetite and financial goals.

3. AI in Lending and Credit Access

Getting a loan in many African countries has traditionally been challenging due to strict banking requirements, collateral demands, and high interest rates. AI is revolutionizing the lending industry by providing faster, more accessible, and more personalized loan options.

How AI is Improving Loans:

- Alternative Credit Scoring: Instead of requiring traditional credit history, AI analyzes mobile money transactions, social media activity, and spending behavior to assess creditworthiness.

- Fraud Detection: AI helps detect fraudulent loan applications, reducing financial risks for lenders.

Example: A market trader in Accra who doesn’t have a formal bank history applies for a loan via a fintech app. The AI system analyzes her mobile money transactions and sees consistent income patterns. She gets approved for a GHS 5,000 loan within minutes—something that would have been impossible through a traditional bank.

4. AI-Powered Fraud Detection and Cybersecurity

With the rise of digital banking and online transactions, fraud has become a major concern in Africa. AI is improving security by detecting fraudulent activities and protecting users from scams.

How AI Helps Prevent Fraud:

- Transaction Monitoring: AI tracks spending patterns and flags suspicious transactions in real time.

- Biometric Security: Many banking apps now use AI-powered fingerprint and facial recognition to prevent unauthorized access.

- Anti-Phishing Alerts: AI detects fake websites and scam emails, protecting users from financial fraud.

Example: A fintech user in Kigali receives an email claiming to be from their bank, asking them to enter their PIN. Their AI-powered banking app immediately flags the email as suspicious and warns them not to proceed, preventing them from falling victim to fraud.

5. AI in Financial Education and Personalized Advice

Financial literacy is a major challenge in Africa, with many people unaware of how to manage money, save, or invest wisely. AI is bridging this gap by offering personalized financial education.

How AI Provides Financial Advice:

- Chatbots and Virtual Assistants: AI-powered financial assistants answer questions on money management, investments, and saving strategies.

- Customized Recommendations: Based on spending patterns and goals, AI suggests financial plans tailored to individuals.

- Gamification and Learning Tools: Some AI apps use interactive quizzes and rewards to teach financial skills.

Example: A student in Lusaka uses an AI-powered chatbot in their banking app to learn about investment opportunities, helping them make informed financial decisions at an early age.

AI and the Future of Personal Finance in Africa

AI is rapidly transforming personal finance in Africa, but we are only scratching the surface. In the future, we can expect even more:

- AI-Powered Insurance: Algorithms that analyze risks and offer customized insurance plans.

- Hyper-Personalized Financial Planning: AI that continuously adapts to users’ changing financial needs and goals.

With fintech adoption growing across Africa, AI will continue to shape how individuals manage money, making financial services more accessible, efficient, and secure.

Conclusion

AI is revolutionizing personal finance in Africa by automating budgeting, enhancing savings, simplifying investments, improving loan accessibility, preventing fraud, and providing financial education. As AI-powered fintech solutions become more sophisticated, Africans will have more control over their financial futures.

For anyone looking to take charge of their finances, now is the best time to start leveraging AI-powered financial tools. Whether it’s automating savings, investing smartly, or securing a hassle-free loan, AI is making financial freedom more achievable than ever before.

RELATED ARTICLES

Personal Finance for University Students