When I sat down to hear Emmanuel Dogbatsey Doe’s story, the Ghanaian influencer popularly known as Don Sarkcess, I knew exactly what I wanted to understand first.

How does someone go from being “naturally a spender,” the kind of person who buys the next sneakers, the nicest clothes, and loves treating loved ones to being disciplined enough to save thousands of dollars, buy their first car outright, and start multiple businesses?

Not in theory. Not in “finance Twitter” threads. In real life, in an economy like Ghana’s, where opportunities are limited, salaries are modest, and temptation to spend is high.

If you’ve ever tried to save, you know it isn’t just about self-control. It’s about access to tools you trust, systems that keep you accountable, and a mindset shift that takes you from “money in, money out” to “money in, money grows.”

For Don Sarkcess, that turning point came with Accrue, a cross border payment app that helps you receive money in dollars and send money across Africa.

A Spender Learns to Save

Like many young Ghanaians, he had the same long-term dreams of owning a car, having a safety net for emergencies, and eventually buying property, but he also knew himself, without a system to “tame” his spending, those dreams would stay dreams.

“I’ve always been the kind of person who spends as soon as money hits my account,” Emmanuel admits. “If it wasn’t on family or necessities, it was on things I just wanted.”

Things took a turn when he stumbled upon Accrue. “I think I saw someone post about it once,” he recalls. “I checked it out, looked at some competitors, but as a finance person, I understood the name ‘Accrue’ right away; money that grows over time. When I got on the app, my first love was the Vault Savings feature. Once you lock your money there, you can’t touch it, even if you’re ‘dying’ in the best way possible.”

He started small and inconsistent. His income at the time wasn’t great. However in early 2023, everything shifted, a new job in marketing, and several accounts to manage under his belt.

“Suddenly I had more coming in, and I didn’t want to spend it all. So I saved aggressively. That’s what sped up my ability to buy my first car.”

Hitting A Savings Goal

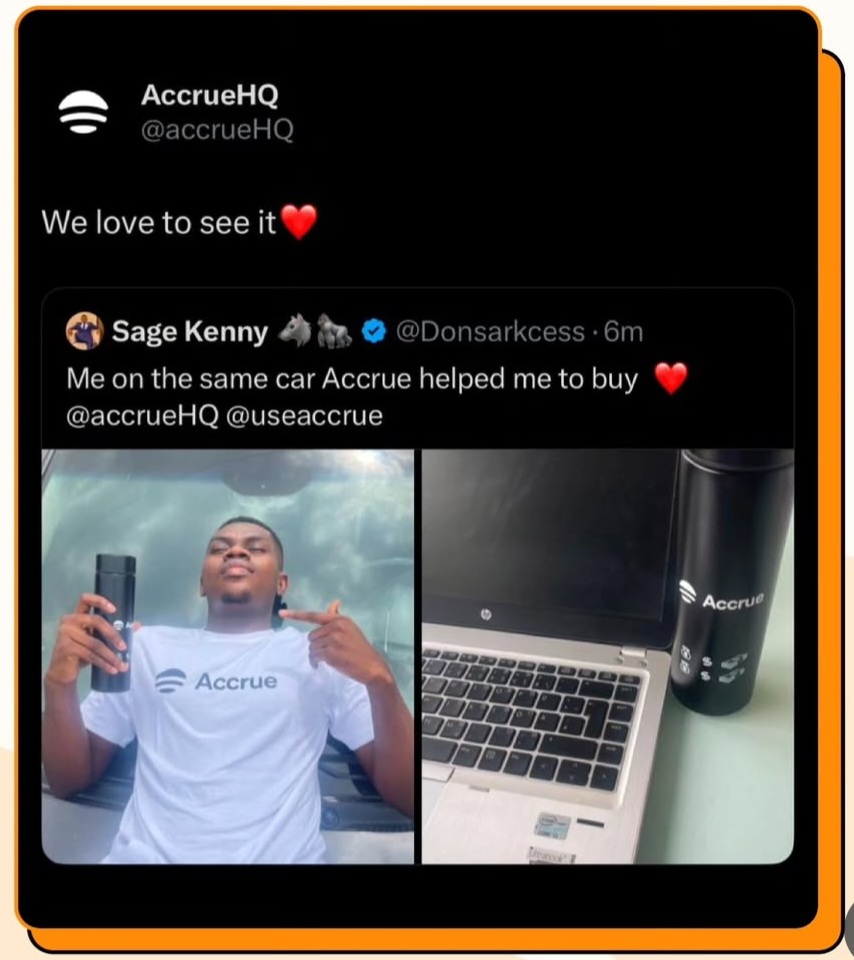

When Emmanuel’s dream of buying a car became reality, which was aided by his aggressive saving on Accrue, he became loud on his evangelism about Accrue, the payments platform that helped make his dream a reality. This led to his onboarding as an Accrue ambassador and what makes his deal different from many influencers: he was a user before he was ever paid to talk about Accrue.

“If tomorrow I’m no longer in partnership with Accrue, I’d still post about it,” he says matter-of-factly. “I tell people about things that actually help me. My siblings all use it now, even my mom.”

For Emmanuel, trust isn’t built in a shiny product. It’s built in how well it works when you need it. When his account was once flagged for security after reaching a high savings balance, he didn’t panic, he contacted support, got it resolved in minutes, and then helped other users who faced the same issue.

“That’s the kind of confidence I have in this app,” he says. “It’s why people come to me with their questions before they even go to Accrue directly.”

How Do You Hit Your Savings Goal?

Saving isn’t magic. It’s planning. “You have to know what you’re saving for before the money even comes in,” he explains. “If you earn 2,000 cedis, decide from day one that 100 cedis is for rent, 200 is for emergencies, 400 for your car goal. Then you know exactly where your money is going. That’s how you avoid getting to the end of two years and realizing rent is due but you have nothing.”

He learned that lesson the hard way. Early in his career, he landed a job that paid three months’ salary in dollars upfront after training. “I was the richest man in my town for a month,” he laughs. “I changed my room, bought clothes, shoes, and gave everyone money. But then reality hit, salaries came monthly, and I had to learn how to manage.”

That experience reshaped him. Today, every cedi has a purpose, whether it’s for his next business, his family’s emergencies, or community projects like donations to schools for the blind.

I asked Emmanuel the one word he’d use to describe Accrue, and he didn’t hesitate: “Lifesaver.”

A Lifetime Ambassador

For Emmanuel, saving with Accrue isn’t just about hitting financial milestones. It’s about creating options, freedom, and resilience in a country where stability can feel fragile.

“It’s allowed me to start businesses I never thought I’d own,” he says. “It’s given me the confidence to help my family without hesitation. And it’s made me the guy people trust when they want to know where to put their money.”

As for the future? Emmanuel wants to stay with Accrue for the long haul, as a user, advocate, and part of the family.

“I want to be here five years from now, still saving, still telling people about it,” he says. “Because I know it works. And when you find something that works, you hold on.”

Today, when Emmanuel Dogbatsey Doe talks about money now, his voice is steady. Calm. Like a man who knows exactly where his next rent is coming from, exactly how much he can give his mom if she calls, exactly how long his savings can carry him if work dries up.

I’ve lived many lives, but one lesson ties them all together: money is only as powerful as its utility. Through my work, I share stories about money and create guides for Africans who want to get the best out of theirs.