Wiza Jalakasi is a builder, operator, writer, and global fintech executive. Still, at his core, he’s a problem-solver who has learned to turn curiosity into competence and competence into impact.

His journey from fixing viruses on neighborhood computers to helping scale fintech infrastructure across the continent is one driven by relentless learning, long-term thinking, and an unusually patient approach to opportunity.

The Early Spark

Wiza didn’t grow up with a fully mapped-out dream. “I don’t think I’ve always known what I wanted to do,” he says. But he always knew he wanted to build with technology. His father imported computers from South Africa, and watching him work sparked a quiet fascination. “I would see him always working on computers and wonder what he was doing. So I wanted to understand it too.”

That curiosity became the beginning of a lifelong path. He spent hours helping his father voluntarily, long before he developed the skills that could earn him money. But the first time he charged for his talent, everything changed.

His first paying client was a man who needed help removing computer viruses. The payment was 7,000 Malawian kwacha, roughly $30–$40 at the time. A fortune for a kid who hadn’t even entered high school.

“It was early days,” he laughs. “But after that, I realized these skills could become something real.”

From there, Wiza experimented with everything he could build. He ran computer consultancies, worked in an internet café helping people set up Facebook accounts for 1,000 kwacha each, developed websites, and even built Malawi’s first music download platform. He later launched a web design studio that created the website for the Malawian police service, a major breakthrough for a young entrepreneur still figuring things out.

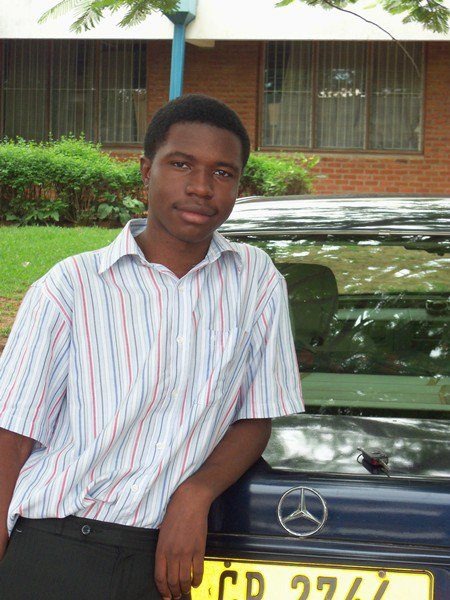

Above image shows Wiza after handing over the Malawi Police Website at Malawi Police HQ in Area 36, Lilongwe

Wiza on launch day of MwTunes.com

The Turning Point Into Corporate

Eventually, the limitations of scale shifted his direction. He raised venture capital and built a reasonably strong business, but it became clear that growth wasn’t happening fast enough to survive. So he made a tough decision: step away.

What came next was unexpected. While exploring building on top of Africa’s Talking APIs, the company offered him a part-time contracting opportunity. The role evolved into much more: infrastructure development, commercial expansion, and eventually scaling operations across the region.

By the time he realized what they were building, he was all in.

“It was more engaging, more profitable, more scalable than anything I could build alone,” he says. “So that’s how I got into corporate.”

From there came the leap into fintech and his transition to Chipper Cash, a move that came with higher stakes, deeper responsibility, and real financial impact. “When you’re dealing with people’s money, the stakes are different. There’s no room for error. You’re in the business of trust.”

The Power of Visibility

The now-famous brand was a strategic experiment.

“I wanted to be associated with something clear,” Wiza explains. “Africa. Fintech. And the .com domain was available, so I thought, why not?”

The internet did the rest. Today, nearly everyone in African tech refers to him by that identity.

If there’s one decision that changed everything, it was writing in public.

“I was writing a lot about my journey building Africa’s Talking,” he says. “I wasn’t doing it to be followed — I wanted realistic stories to balance the hype about African tech.”

“Additionally, I started posting a lot of my thoughts to Twitter, and quickly gained an audience who began to view me as a neutral and reliable voice in the ecosystem. I spent a lot of time trying new fintech apps and reviewing them on Twitter. I ended up writing a blog post that was then reposted in Quartz Africa.”

Those writings changed his trajectory. Opportunities started coming. Investors, founders, and companies sought him out. He never needed to apply for a job again.

“All the roles I’ve had were people reaching out saying, ‘We know about you, would you be interested?’”

It taught him a crucial lesson: your network is the real unlock. People can speak for you in rooms you’re not in.

Money, Mindset & Earning Globally

Asked Wiza what changed when he started earning in dollars, and he laughs: “First thing, the dollar is sweet. Nobody should lie to you.”

Beyond the humor is a serious point: earning in stable currency reshapes how one understands investment, wealth preservation, and opportunity.

Saving in USD changed everything. Even 3–4% returns generated massive gains when converted back into a depreciating local currency. It also gave him the freedom to help family effortlessly, sometimes solving problems with what equates to $40.

“It completely changed the way I view opportunity. I no longer think only within Africa. I know I have what it takes globally.”

Chasing the Future

Right now, Wiza has one major personal target: a seven-figure goal he intends to hit in the next five years.

“If it works, insh’Allah, then I won’t have to work because I need to, but because I want to.”

Two things elevate his output today: using LLMs to refine thinking and writing, not to replace it, and saying yes to conversations and speaking opportunities — big or small

“You never know who you’ll meet or what idea will unlock something new.”

For Wiza, success isn’t just money or titles. Its impact. It’s solving real problems. It’s helping people move money easily enough to buy medicine for someone who needs it. And it’s building things that outlive the hype.

The Human Behind the Hustle

When he’s not building the future of fintech, he’s gaming. PlayStation 5. Gaming PC. Nintendo Switch. Steam Deck.

“The only thing I don’t have right now is Xbox,” he jokes. His favorites are Fallout 4 for nostalgia, and currently The Outer Worlds 2 and Battlefield 6, where he battles 18-year-olds who play all day. “They’re too hard to beat, bro.” Though it looks like he’s starting to get better.

I’ve lived many lives, but one lesson ties them all together: money is only as powerful as its utility. Through my work, I share stories about money and create guides for Africans who want to get the best out of theirs.