Ways you can Save in Dollars on Accrue

1. Savings Pocket

Your Savings Pocket earns daily dollar interest. There’s no lock-up or fees. Save when you want, and withdraw just as easily.

2. Goals

Goals let you save towards a goal. For example, you can save for going on a December vacation with friends. Pro tip: you can even invite friends to contribute to your savings goal.

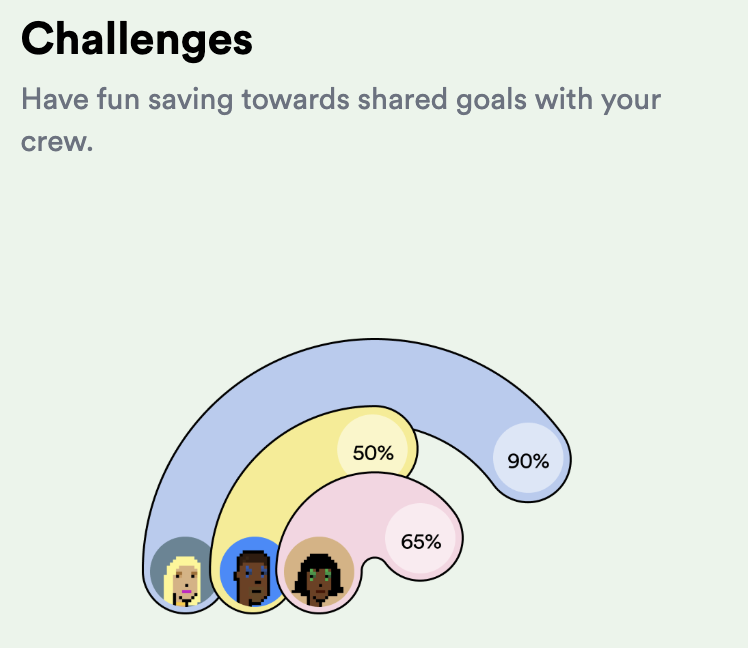

3. Challenges

Challenges let you competitively save towards an objective with other people. For example, you can join a group of people trying to save $300 by December for enjoyment.

4. Vaults

Vaults let you put money away for a chosen period. It’s where you store money you don’t want to get access to for a while.

How does it work?

It all starts with you downloading the Accrue app on the App Store or Google Play Store. Once you’ve done this, go through the KYC process, deposit money into your account, and then move it to either your Savings Pocket, Goal, Challenge, or Vault.

Once you’ve done this, you’ll earn your first dollar interest within 24 hours and continue to do so uninterruptedly every day for 365 days. There are no fees, and you can withdraw your money at any time in minutes.

Start Saving in Dollars on Accrue 👇🏾👇🏾

Why save in dollars?

Saving in dollars on Accrue helps you protect the value of your long-term savings from currency devaluation.

For example, if you’re saving to buy a car in two years or you’re saving for your Master’s tuition in six months, saving in your local currency means that your savings might lose a decent chunk of its value when you’re finally ready to make payment. The Ghanaian Cedi, for instance, devalued from 6gh to 15gh in 2022. If you had long-term savings in cedis, its value would have been wiped out, leaving you unable to make the purchase you wanted.

This is where saving in a strong, stable currency like the Dollar helps. It does not experience as much devaluation, so your long-term savings will hold its value better.

Tips for saving in dollars

- Don’t save money you’ll need in the short term, especially not the money you need for your day-to-day upkeep.

- Dollar Savings work best for long-term (3 – 36 months) savings — money that you want to ensure holds its value for as long as possible.

- Don’t approach Dollar Savings with the mindset that you want to gain from the devaluation of your local currency.

- This mindset causes emotional stress and potentially bad decisions because of the day-to-day price swings in the exchange rate.

- Approach Dollar Savings as a way to protect your purchasing power because you’re saving in a strong, stable currency.

- Consistency is how you win with Dollar Savings. Set aside an amount to invest daily, weekly, or monthly. That way, you’re investing in the “high” and “low” exchange rates.

How risky is it?

Dollar Savings on Accrue offer guaranteed returns that are paid out daily, so if you’re looking for a low-risk way of growing your money, this is definitely for you.

RELATED ARTICLES

How I Saved My First $200 in University Last Year

How to Make Money From Your Hobbies

What Are the Best Side Hustles for Quick Cash?

Receive Money In Africa With Our Virtual USD Accounts

Send and receive money across Africa and the US with ease!