-

How to Get Paid on Upwork with Accrue USD Bank Account

The gig economy is booming across Nigeria and Africa, with more freelancers offering services to clients worldwide through platforms like Upwork. From developers and designers to writers and virtual assistants, freelancers are tapping into Upwork like never before. However, one persistent challenge remains: how to receive payments efficiently, quickly, and at the best possible rates…

-

How creators in Africa can get paid in USD with Accrue

When I used to write on Upwork, receiving dollar payments was usually a problem. Like me, if you’re earning in dollars from platforms like YouTube, Upwork, Contra, and other freelance gigs, or your Shopify store, when you click “Add payout method” and you’re asked for a US bank account or US billing address, it becomes a problem.…

-

Should You Save in Dollars or Local Currency?

Saving money has never been easy. In Nigeria, it often feels like you’re running on a treadmill that keeps speeding up. Prices rise, the naira loses strength, and the money you carefully set aside today can feel smaller tomorrow. In the middle of all this, one question keeps coming up: should you save in naira…

-

How to avoid cross-border card declines when shopping online

It was 11:47 p.m in Accra, Ghana. You’ve added everything to your cart. Compared prices twice. Calculated the exchange rate in your head just to be sure. You enter your card details, click “Pay Now,” and hold your breath. Processing… Then it appears. Transaction Declined. You try again. Same result. You switch browsers. Same result.…

-

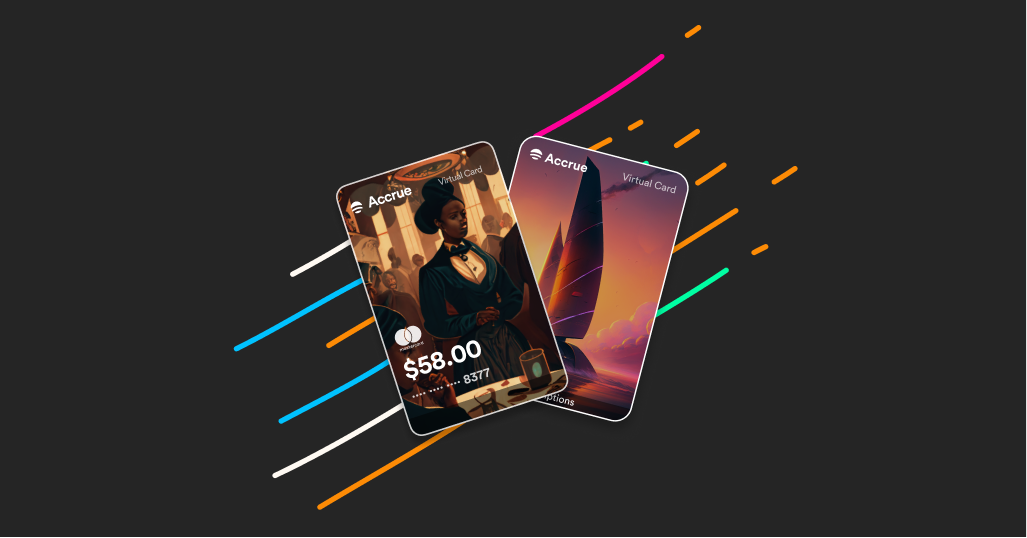

Virtual card vs physical card: which is better for online shopping?

I’ve used both virtual dollar cards and physical debit cards for shopping and online payments. Chances are, you have too. But if you think about it, the way we manage and spend money has changed dramatically over the years. Not long ago, your physical debit card was your primary way to make payments. Today, we…

-

How to Shop from the US While Living in Africa (A Complete Guide)

There was a time when buying something from the United States while living in Africa felt like a privilege reserved for people with traveling uncles. You needed someone flying in from New York City, or a cousin returning from Houston, or a friend who could “help you buy and bring.” Today, whether you live in…

-

How to Shop Internationally With A Virtual Dollar Card (Step-by-Step Guide)

My friend Jake had spent time filling up his cart with bespoke clothes from Shein and some electronic accessories from Amazon. You know the feeling of finally checking out the things you have picked out, but then, when he clicked checkout, entered his card details on Shein and Amazon, and waited. “Payment declined.” He tried…

-

Hidden Fees Explained: How To Read A Money Transfer Quote

When Daniel, a Lagos-based fabrics dealer, sent $12,000 to his Ghanaian supplier for fabric, his bank charged a $60 wire transfer fee. He did the math, approved the transfer, and moved on. Two weeks later, his supplier called: only $11,540 had arrived. Where did the missing $400 go? Welcome to the jig-saw world of hidden…

-

How To Stop Fraud When Sending Money Abroad

Sending money internationally has never been easier. With a few taps on your phone, you can support family, pay suppliers, invest abroad, or handle emergencies across borders. At the same time, however, the rise of digital payments has created new opportunities for fraud. While reputable money transfer providers continue to strengthen their security systems, scammers…

-

How Faster Transfers Changed How These Families Plan

For years, my family planned our finances around irregular payments because the money took days to arrive due to “processing times,” and to create a buffer, extra money was sent. Then, the situation changed as transfers became faster and more reliable; something deeper changed. Families like mine didn’t just gain convenience; we gained control. We…