-

How To Have a Fun-Filled Valentine’s Day: A Single Person’s Guide

Celebrating Valentine’s Day as a single can be depressing, you know, because Valentine’s Day is that magical time of the year when couples suddenly do nothing but act lovey-dovey. If you’re single, this day can feel like a personal attack, but hear me out: Valentine’s Day as a single person can actually be fun after…

-

Love on a Budget: How To Celebrate Valentine’s Day Without Going Broke

The moment gift box vendors start flooding your timeline with red ribbons, teddy bears, and “last-last discount,” just know Valentine’s Day is knocking aggressively. We can argue later about why an ancient saint’s death is now responsible for emptying our bank accounts. For now, let’s focus on the real issue: how to avoid being labeled…

-

Five Ghanaians Talk About Their Most Memorable Valentine’s Day

Valentine’s Day rarely stays the same. What begins as something soft and exciting often grows complicated with age, shaped by money, distance, marriage, faith, and the quiet realities of adulthood. For some people, one Valentine’s Day becomes unforgettable not because it was perfect, but because it revealed something true about love. These five Ghanaians reflect…

-

Best Ways to Celebrate Valentine’s Day in Ghana

Valentine’s Day is fast approaching, and whether you’re deep in love, newly dating, or simply looking to celebrate romance in style, planning the best ways to celebrate Valentine’s Day in Ghana can feel overwhelming. If you’re not quite sure where to start, don’t worry, you’re in the right place. Accra is becoming a romantic city…

-

The Future of Cross-African Payments: Opportunities and Regulatory Pinch Points

Jump to a section: Cross-border remittances in Africa have grown in recent years, but they remain dominated by outside-of-Africa flows and high fees. In 2023, Sub‐Saharan Africa (SSA) received about $54 billion in remittances[1] (a slight –0.3% decline from 2022). The top recipients were Nigeria (∼$20.5B) and Ghana ($4.8B)[2], followed by Kenya ($4.2B)[3]. Together, these three…

-

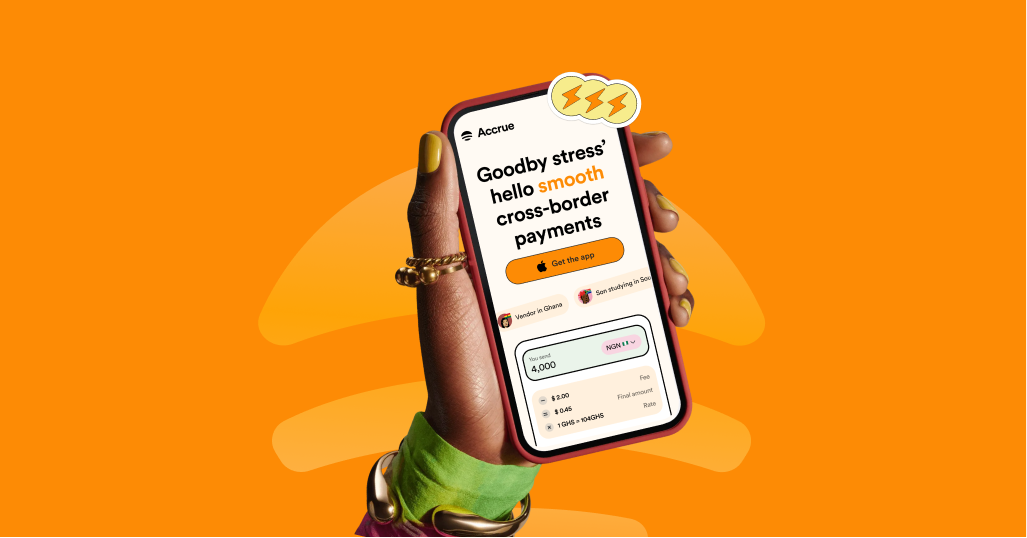

PayPal–Paga Integration: Why Accrue Remains the Better Option for Nigerians

When news broke recently that Paga had integrated PayPal, it was seen as an expansion and inclusion of the country into the global economy. With the rise of freelancing, remote work, e-commerce, and the creator economy, access to dollar payments has become more important than ever. However, instead of excitement, the announcement was met with…

-

Send money from the US to Nigeria: ACH vs Wire vs Accrue Dollar Account

When you send money from the US to Nigeria, it can feel like it should be as simple as clicking “transfer” and moving on. But the moment you choose how to send it, ACH, an international wire, or a fintech Dollar account, you’re quietly locking in a whole set of trade-offs that directly affect your…

-

Local Cash Pickup vs Bank Transfer vs Wallet, Which Is Best?

You know, sending money used to be simple: cash in an envelope or a direct bank deposit. Today, you’re spoiled for choice and slightly overwhelmed. Local cash pickup, bank transfers, and digital wallets all offer speed, security, and convenience. Yet choosing the wrong option can mean high fees, long delays, or a frustrated recipient. In…

-

Five Ghanaian Freelancers Talk About Their First Biggest Paycheck

Freelancing in Ghana is growing rapidly as more young professionals turn to online jobs and remote work to earn in dollars and other foreign currencies. With rising living costs, limited local job opportunities, and increased access to global platforms, many Ghanaians are building careers as writers, designers, developers, virtual assistants, and digital marketers. In this…

-

How To Use PayPal in Nigeria

You’re a freelancer, a digital nomad, a digital creator, or a business owner in Nigeria. PayPal is one of the ways to receive payments globally; however, its functionality comes with significant limitations. PayPal accounts in Nigeria are linked to third-party apps (or a partner). This means users cannot create a PayPal account directly, but must…