Whether you’re a freelancer working with international clients, a student receiving school fees from abroad, or a small business owner accepting cross-border payments, a USD account is now more essential than ever in Ghana.

But if you’ve ever tried opening one at a traditional bank, you already know—it’s not easy.

The Struggles of Traditional USD Accounts in Ghana

Opening a domiciliary (foreign currency) account in Ghana often feels like you’re solving a puzzle with missing pieces. Here’s what most banks will ask for:

- Proof of source of funds (invoices, contracts, remittance history)

- Minimum deposit requirements (often $100–$500 to open)

- Utility bill + Ghana Card + passport photo

- Face-to-face interviews with branch staff

- Delayed access to receive or withdraw USD

- High fees and FX restrictions for converting or withdrawing funds

And even after all this, your bank may still block or delay international inflows, especially if it suspects fraud, even when the funds are legit.

But, there’s a better way:

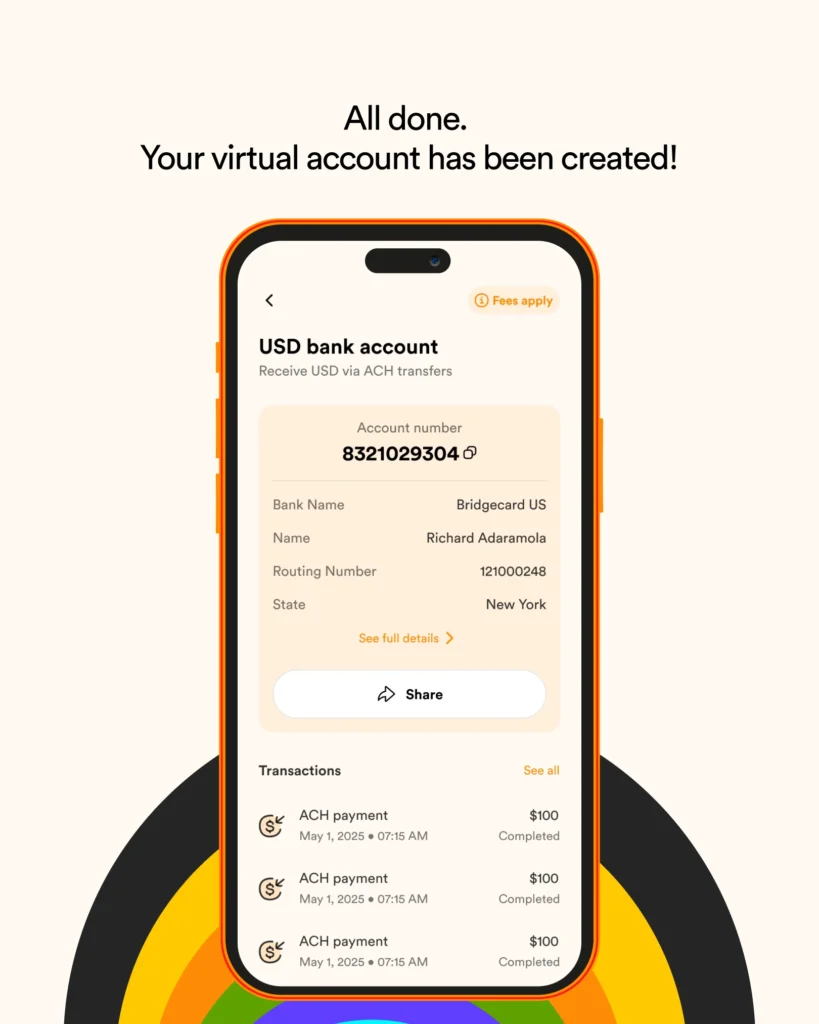

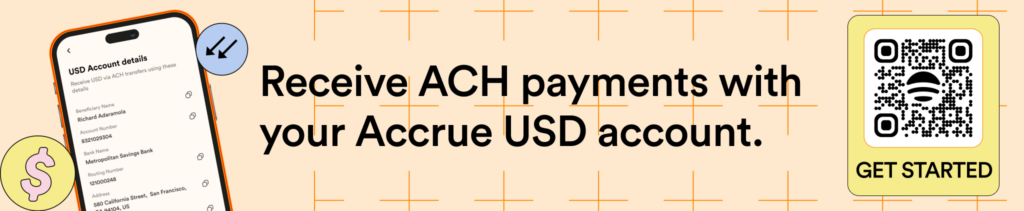

Open a USD Account in Ghana with Accrue

Accrue simplifies everything. You can now open a personalized USD bank account in your name—right from your phone. No paperwork. No stress. No banking halls.

How It Works

1. Sign Up

Visit useaccrue.com and create a free account. The app is available in Ghana and built for people who want simple, fast, and secure access to USD.

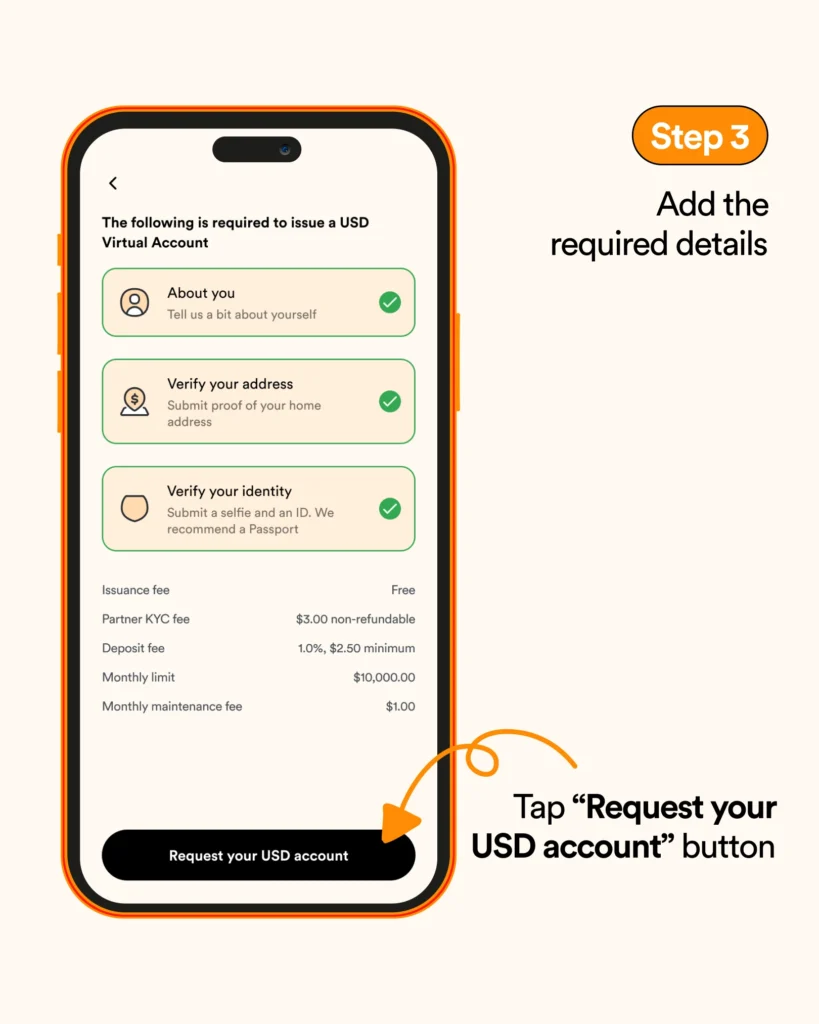

2. Complete KYC Digitally

No trips to the bank. Accrue uses a secure identity process powered by Persona. All you need is:

- A valid International Passport

- A selfie to match your identity

- (Optional) Your GhanaPost GPS or utility bill for enhanced access

Your details are verified in minutes.

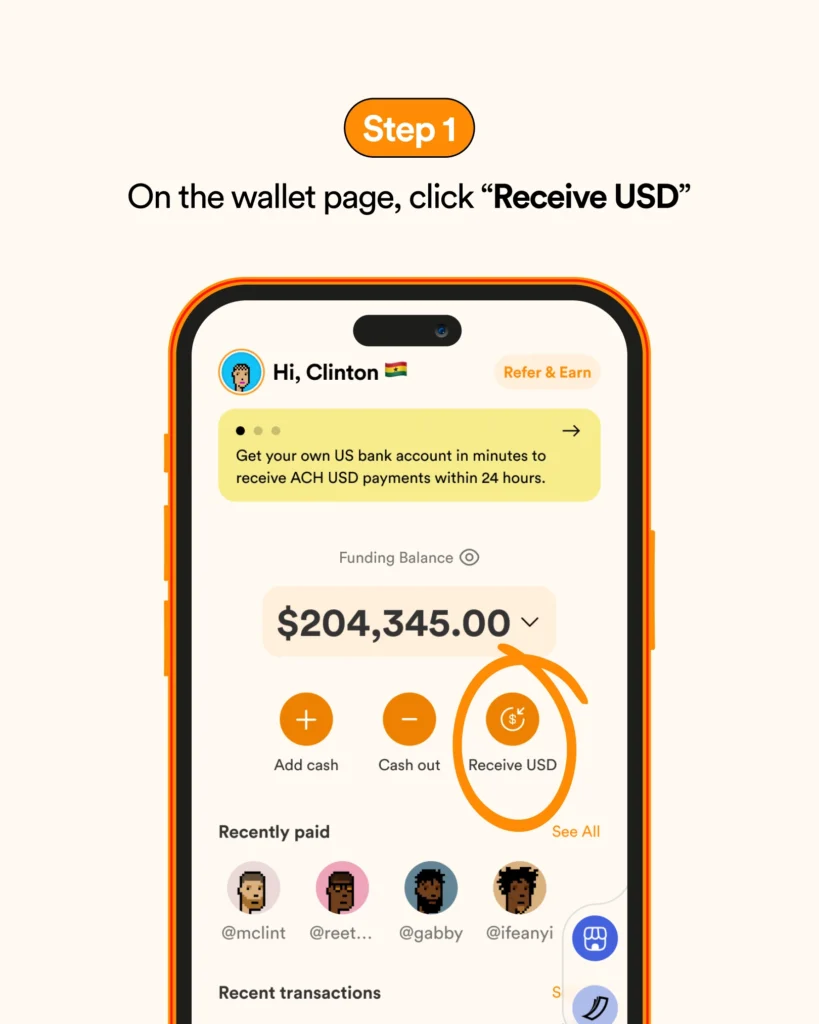

3. Get Your USD Account Instantly

Once verified, you receive your own U.S. bank account (in your name) that can:

- Receive USD payments from clients, employers, or family abroad

- Store your funds safely in dollars

- Let you save, convert, or spend as you like

Why Ghanaians Love Accrue

- No minimum deposits

- No hidden fees or currency delays

- No paperwork or long queues

- Fully digital onboarding

- Backed by secure U.S. banking partners

Whether you’re collecting funds from the U.S. or anywhere else, as long as it is in dollars, Accrue gives you control over your money without restrictions or excuses.

Real Talk: Why This Matters

With the Ghana cedi’s volatility and rising FX pressure, having access to a USD account is a smart financial move. It protects your income, supports remote work, and opens doors for seamless international trade or study.

Ready to Start?

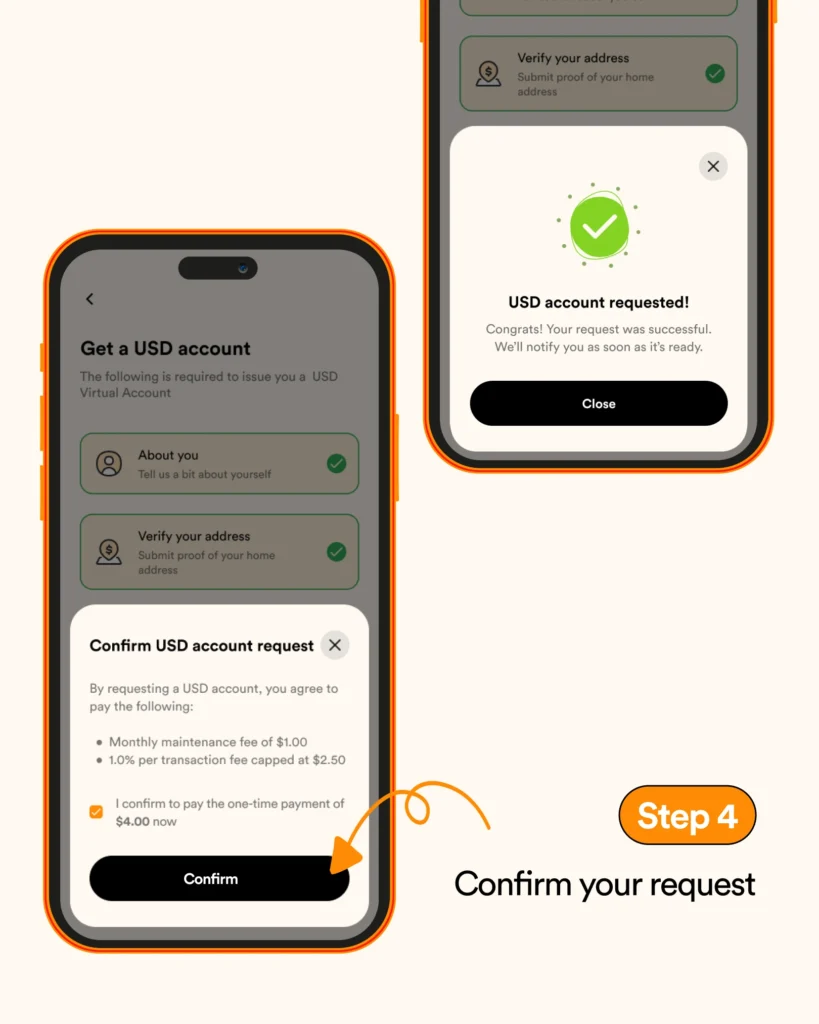

- Go to useaccrue.com

- Complete your KYC

- Accept the terms

- Start receiving USD today

Gone are the days when opening a USD account in Ghana was reserved for businesses or the well-connected. With Accrue, it’s about convenience, inclusion, and speed. Join thousands of Ghanaians taking control of their finances—one dollar at a time.

MORE FROM ACCRUE