If you’ve ever tried opening a USD account in Nigeria through a traditional bank, you probably know how frustrating it can be.

From lengthy paperwork, endless visits to the bank, and unclear requirements, to the demand for referees, proof of international transactions, or even minimum deposits of $100 or more, it often feels like you’re being punished for trying to access your own money in a stable currency.

But here’s the good news: There’s a better way.

Accrue: The Stress-Free Way to Open a USD Account

Accrue is revolutionizing the way Nigerians save and transact in dollars by offering personalized USD bank accounts—without the headaches. Whether you’re a freelancer, remote worker, business owner, or student, Accrue makes it easy to open and operate a USD account from your phone in just minutes.

The Traditional Bank Struggles

Before we dive into how Accrue works, let’s quickly recap the typical USD account opening process in Nigeria:

- You must physically visit the bank (often more than once)

- Provide two referees with existing domiciliary accounts

- Show utility bills, government ID, passport photos, and sometimes tax ID

- Wait days—or even weeks—for approval

- Fund the account with a minimum deposit of $100 or more

Even then, receiving international payments (especially from platforms like Upwork, PayPal, or Fiverr) isn’t always guaranteed.

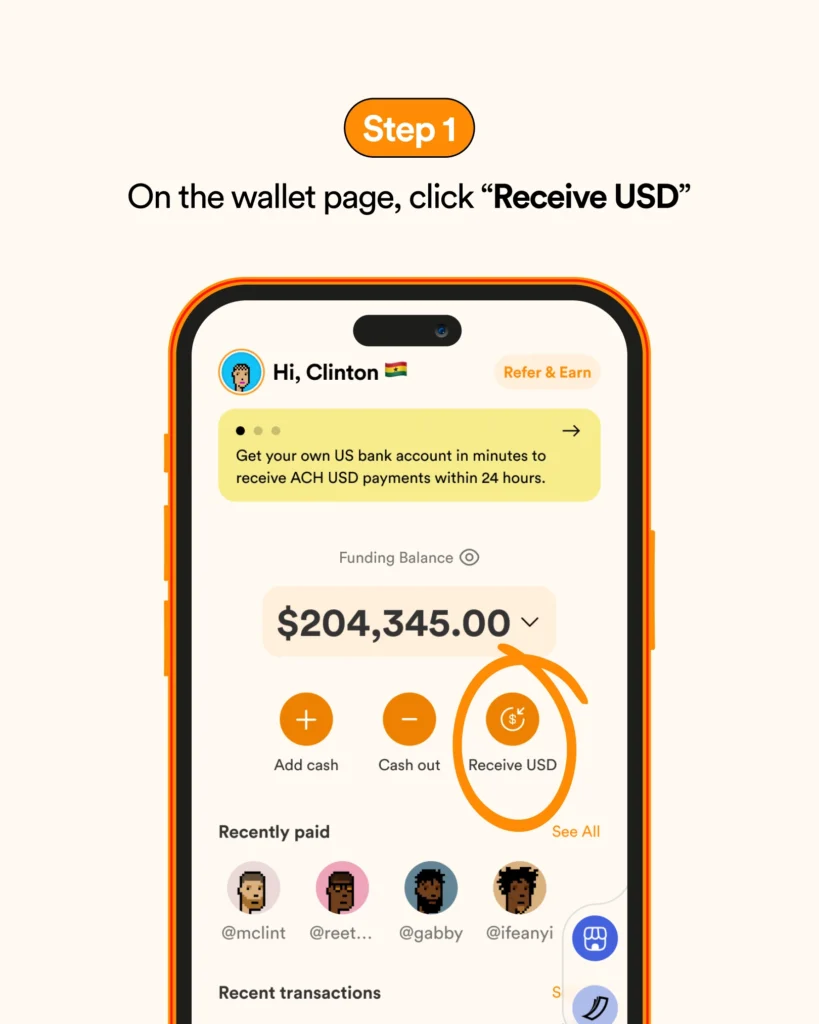

How to open a USD Account in Nigeria on Accrue

With Accrue, you can open a fully functional USD account powered by regulated U.S. banking partners. Here’s how it works:

1. Sign Up in Minutes

Download the Accrue app, create an account, and start your KYC verification.

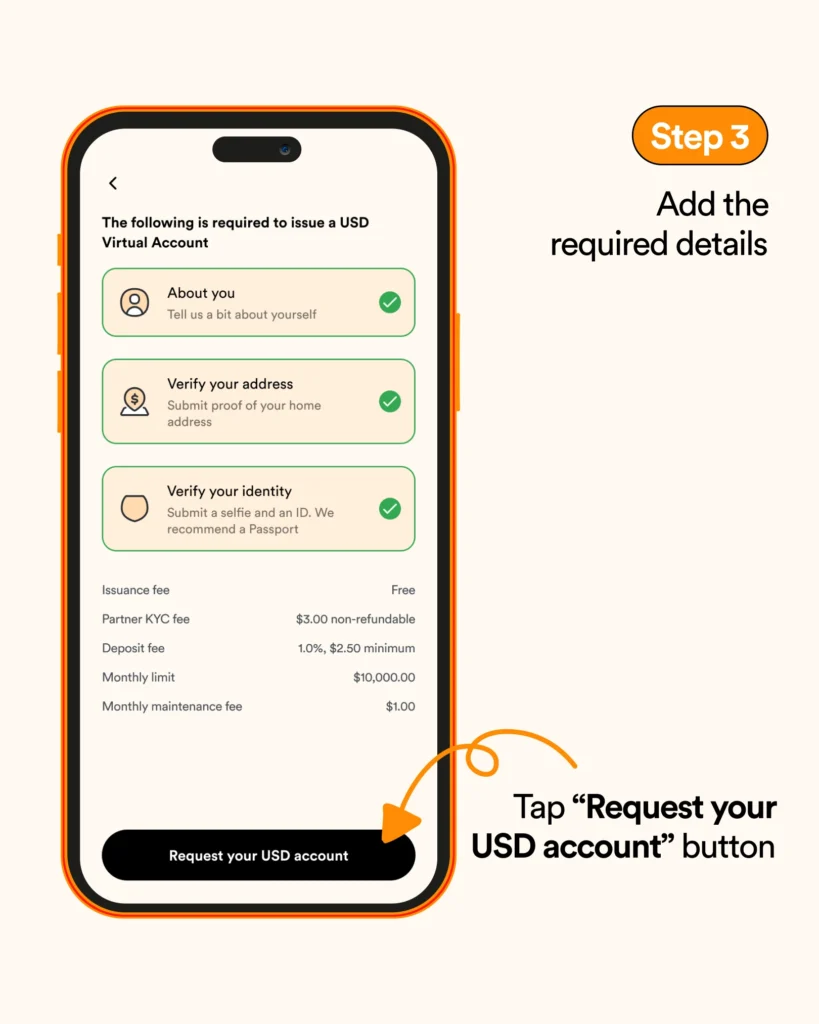

2. Easy, Paperless KYC

Forget scanning documents or printing forms. Accrue uses a secure and seamless digital identity process powered by Persona, so you can verify your identity securely using just:

- A government-issued ID (e.g. NIN Slip, Voter’s Card, or Passport)

- A selfie for identity match

- Your BVN to link your identity (optional but improves access)

No referees. No printouts. No waiting rooms.

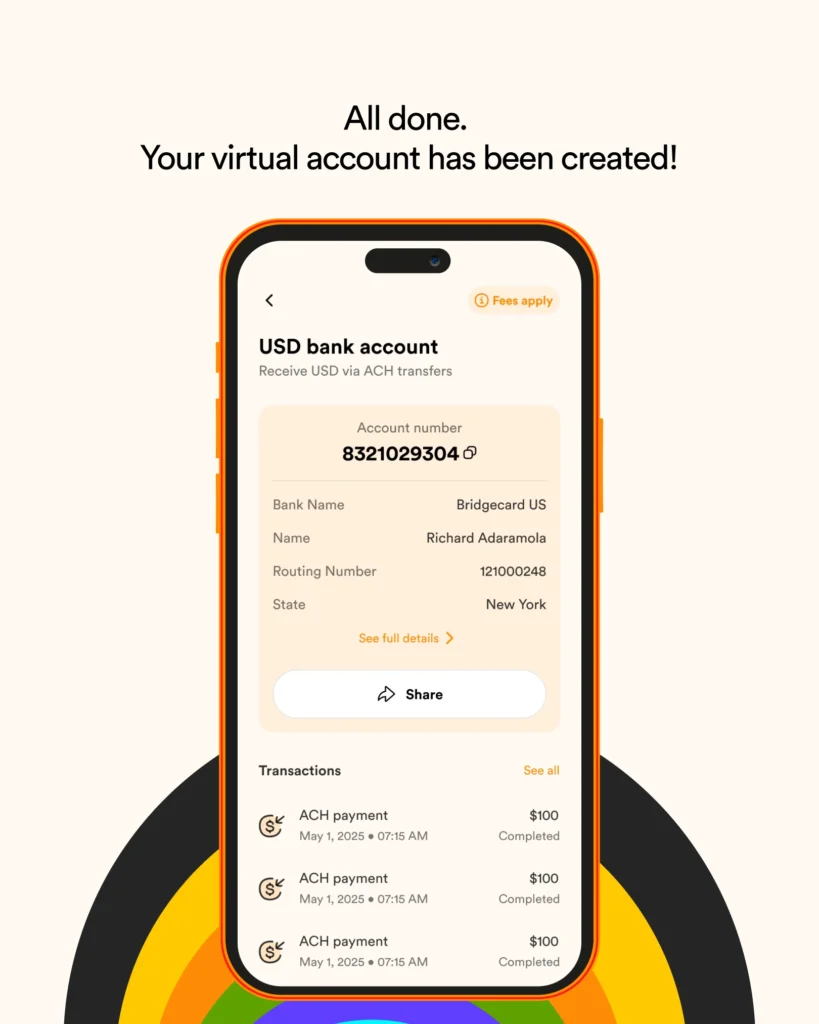

3. Get Your USD Account Instantly

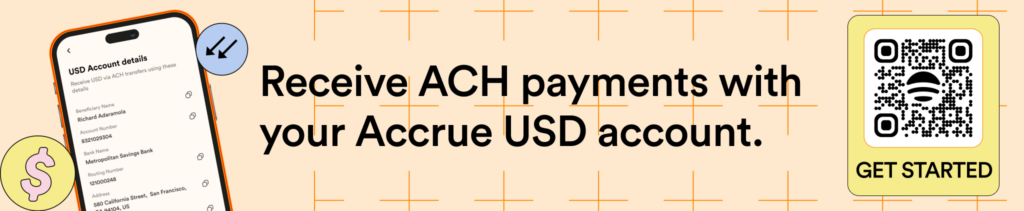

Once verified, you’ll receive your own USD account number, personalized in your name. You can now:

- Receive payments from U.S. clients, platforms, or employers

- Store your earnings in USD

- Save or convert at your convenience

Why You Should Open a USD Account with Accrue

- Avoid Naira volatility: Protect your income from inflation and devaluation

- Receive international payments: Ideal for freelancers, students, remote workers

- No ridiculous charges: No hidden fees, and you control your funds

- Fast onboarding: Most users complete setup in under 10 minutes

- Regulated partners: Your funds are held with secure U.S.-based banking institutions

Ready to Get Started?

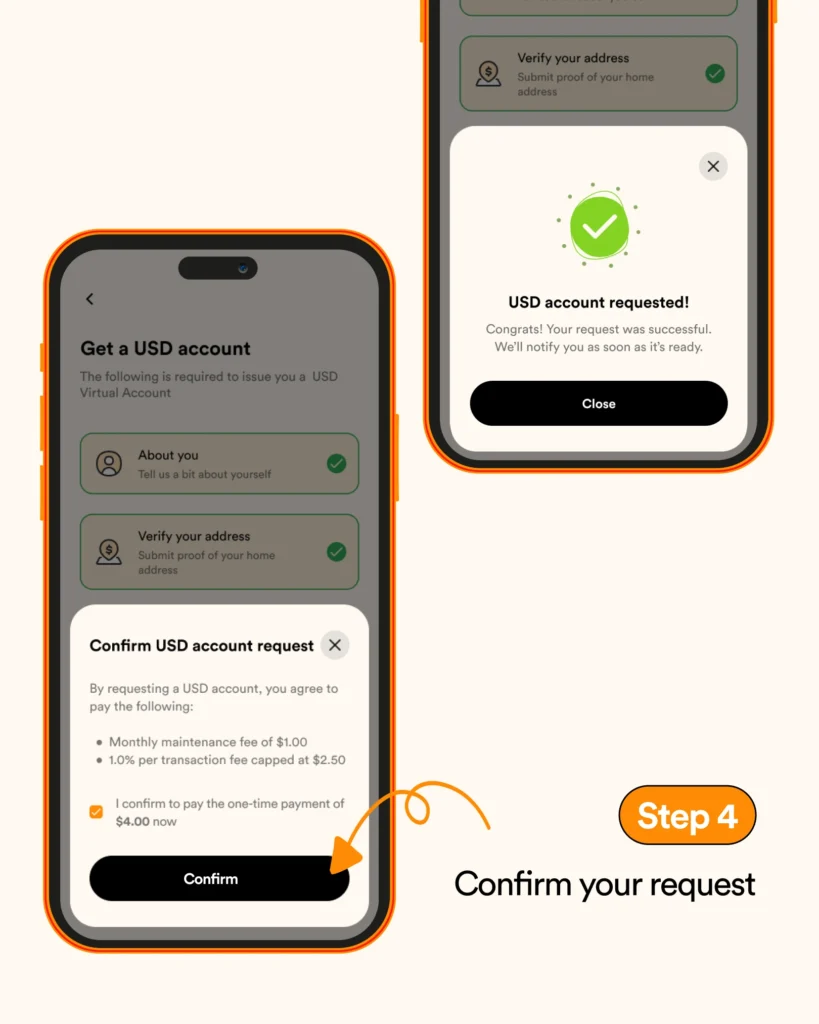

Here’s all you need to do:

- Go to useaccrue.com

- Complete your KYC here

- Accept the terms

- Start receiving USD today

Opening a USD account in Nigeria doesn’t have to feel like a war. With Accrue, it’s smooth, smart, and designed with you in mind. Whether you’re trying to protect your savings, collect payments from clients abroad, or escape the Naira’s volatility, your USD account is just a few clicks away.

RELATED