Updated on December 21, 2024 by Accrue

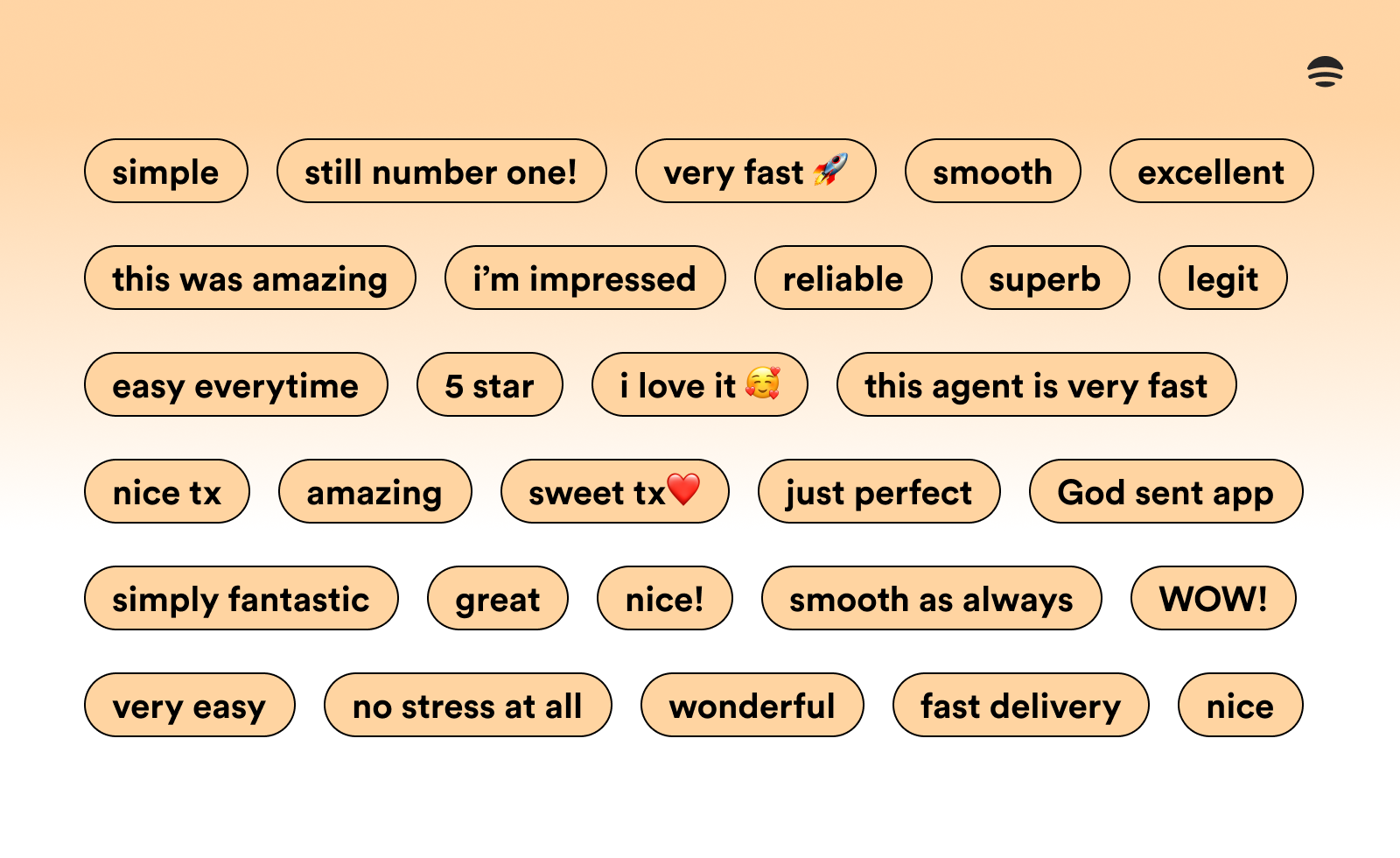

Think back to your first time using crypto. How would you review your experience? If you were an early adopter, maybe you found the experience confusing and jargon-heavy, the irreversible nature of transactions deathly terrifying, or even all of the above. With that thought in mind, would it surprise you to learn that the reviews above are from everyday Africans using crypto?

A groundbreaking crypto onboarding is happening in Africa. One that’s easy, delightful, and durable. Unlike the onboarding you might have gotten, this one is rooted in practical utility rather than speculation, offering tangible benefits without the risks typically associated with (volatile) cryptocurrencies. At the forefront of this shift in experience and adoption are P2P stablecoin agents armed with smartphones and unexpectedly sharp crypto knowledge, who are invisibly bridging fiat <> crypto, allowing everyday Africans to access the superpowers of stablecoins.

Meet the new bankers

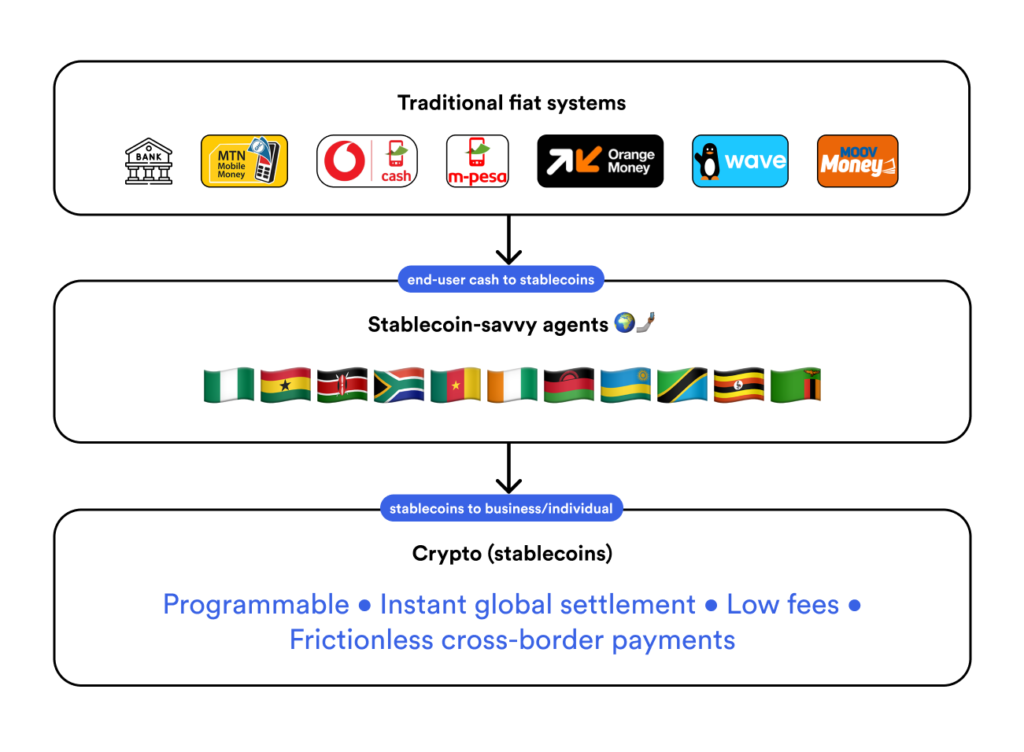

In the context of this burgeoning shift in crypto onboarding, a P2P stablecoin agent is a crypto-savvy local with fiat and stablecoin (USDC/USDT) liquidity who seamlessly helps “normie” users convert fiat to stables and back in exchange for earnings. Agents are a crucial bridge between the large, underserved African market using traditional fiat systems and the superior capabilities of stablecoins. They provide everyday Africans with safe, fast, low-cost access to stablecoins and the superpowers they unlock. They’re educators, marketers, customer support, and often a delightful first point of contact for many Africans venturing into crypto.

To understand the significance of P2P stablecoin agents, we need to look at their predecessors: traditional mobile money agents. Services like M-Pesa & MTN MoMo revolutionised financial inclusion, allowing hundreds of millions of unbanked Africans to send, receive, and store money in an e-wallet tied to a SIM card in a basic mobile phone. These agents, often operating small shops or kiosks, became human teller machines facilitating intra-border digital-to-physical cash services across Africa.

P2P stablecoin agents are a necessary evolution of this model. While mobile money was transformative, it remains geo-locked within national/regional borders due to the limitations of fiat. Stablecoin agents, however, offer something more:

- Frictionless cross-border payments: Unlike traditional mobile money, stablecoins are borderless, enabling low-cost cross-border payments that settle in minutes. Individuals and businesses can pay or get paid across Africa with the same ease they do with local mobile money.

- Easy access to stronger currencies: By providing safe access to stablecoins pegged to major world currencies, agents offer a way for locals to protect their purchasing power from inflation and/or currency devaluation that plagues many African countries.

- Gateway to the broader global economy: While focusing on stablecoins for stability, agents also introduce users to the broader world of cryptocurrencies, decentralised finance, and global commerce that’s increasingly moving onchain. Permissionless access to high-yield savings, investment opportunities, and global commerce will unlock several opportunities presently in short supply for Africans.

The agent-led leapfrog into the global economy

Mobile money has won the hearts of nearly a billion Africans for instant local transactions. It is available 24/7 and allows instant, reversible, interoperable payments across participating mobile telecoms and banks. In 2022, ~$3.4B was transacted daily, resulting in ~$1.26T in annual transactions.

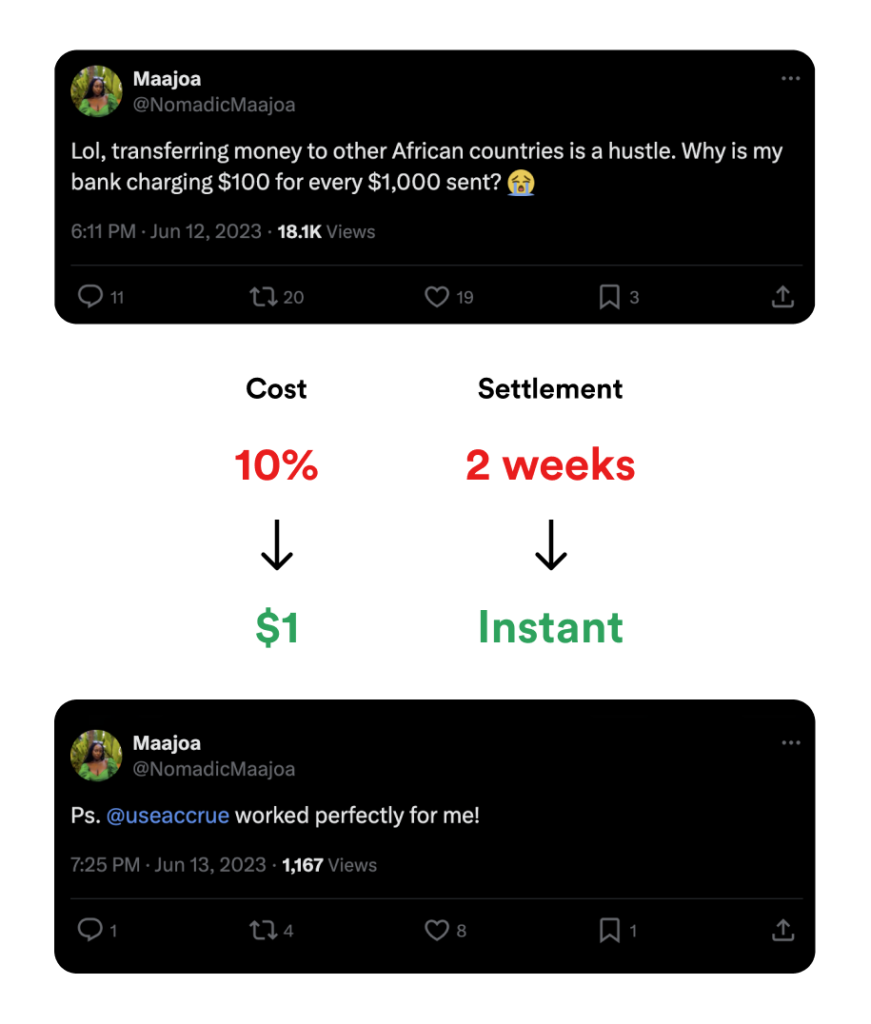

Cross-border commerce in Africa is massive yet severely underserved. In 2022, intra-African transactions reached ~$19B, while diaspora remittances to Africa exceeded $100B. Unfortunately, traditional banking fails to meet this growing demand efficiently, with cross-border payments facing steep costs (10-20%) and long settlement times (3-14 days).

Accrue is capitalising on consumer familiarity with the agent network model to pioneer a borderless stablecoin payment network powered by P2P agents. We’re upgrading the pre-existing network of over 800,000 mobile money agents already on the ground and trusted by hundreds of millions of Africans. Within our network, agents invisibly convert end-user cash to stablecoins and vice versa, enabling instant borderless commerce for a tenth of the cost of traditional banking.

As adoption grows, the implications of this continent-wide borderless commerce infrastructure are profound:

- Financial inclusion: By making it safe and easy to use stablecoins, billions of Africans will permissionlessly gain access to global financial services, high-yield savings, and investment opportunities. They will be able to spend boundlessly, access loans, build a credit score onchain, crowdfund, receive donations, grants and humanitarian aid without intermediaries, and more.

- Boost to intra-African commerce: The United Nations Conference on Trade and Development (UNCTAD) reported in 2021 that intra-African trade was a mere 14.4%, the lowest intra-continental trade percentage globally. By providing easy access to stablecoins that enable frictionless cross-border payments, intra-African trade will flourish significantly. Such growth would complement the African Continental Free Trade Area (AfCFTA) agreement’s objectives, potentially fast-tracking the continent’s economic integration.

- Full value remittance: The average cost of sending remittances to Africa is ~8.35%. According to a World Bank estimate, by reducing the cost to 1.5% (what Accrue charges), Africans would get to keep ~$5B lost to fees annually. The high-cost remittance market will be disrupted, allowing more of the money sent home by diaspora Africans to reach their families rather than being lost to fees.

- Entrepreneurship and innovation: As crypto goes mainstream and a thousand new use cases blossom, we fully expect Africa’s entrepreneurial spirit, combined with its youthful, tech-savvy population, to be at the forefront of internet-based innovation and business creation. This infrastructure will lower the barriers to entry to the global economy, expand market reach, facilitate unprecedented collaboration, boost the gig economy (both global and local), make it easy to attract and receive global investment, and more.

- Reshaping the continent: As stablecoins flow freely across national borders, we could expect to see them do more than facilitate commerce. As Amara, a yoga instructor in Lagos, effortlessly transacts with Kwasi, a video editor in Accra, arbitrary colonial-era borders begin to fade, potentially catalysing a renaissance of Pan-African identity and cooperation. Think of the second-order effects on African collaboration, diplomacy, and collective problem-solving in the years to come.

Win-win-win for users, agents, and the network

I’ll let you in on a hard-won lesson: the only mass-market consumer apps in Africa that stand a chance to win are the ones that help people make money. An inescapable reality is that there simply isn’t enough disposable income for anything else. The convergence of a majority youthful, tech-savvy population with scarce formal employment is the economic reality undergirding the gravitation towards money-making opportunities.

Accrue agents treat their role as a coveted job. They show up daily (sometimes to a physical kiosk) to help “normie” users in exchange for earnings averaging $150/month. Depending on the supply and utilization of liquidity, it could be as high as $1000+/month. For context, $150/month is 3.6x Nigeria’s recently increased minimum wage.

To people who fit the profile of an Accrue agent, it’s an opportunity that’s just too good to pass up because:

- Low barrier to entry: With just a smartphone, internet access and some initial capital, almost anyone can become an agent. We have firsthand experience with agent liquidity oversupply. Thousands of people in Ghana, Nigeria, and Kenya are on our waitlist, eager to become agents.

- Lucrative earnings: In addition to agents’ existing traditional mobile money commissions, upgraded Accrue agents also earn more through an exchange rate spread during fiat <> USDC/T conversions and a profit-sharing commission on each transaction, which can quickly add up for high-volume throughput.

- Job security: Unlike speculative traders, agents have a steady source of income borne of growing stablecoin demand for payments, savings, and investments. Our proprietary matching algorithm equitably assigns available orders to all agents at competitive rates and with sufficient liquidity, ensuring that agents are constantly busy earning.

These benefits foster an alignment of interests where agents’ financial interests are symbiotically linked to the network’s prosperity, resulting in:

- Customer delight: Agents are incentivized to provide fast, reliable payments, excellent customer experience, competitive rates, and comprehensive support to their customers to secure return transactions that they earn from. One result of this incentive structure is that most transactions are completed by agents in less than two (2) minutes and sometimes can be nearly as fast as a mobile money payment or instant bank transfer.

- Exponential, organic network expansion: Successful agents autonomously grow the network by recruiting trusted friends and family as sub-agents, creating a network effect that rapidly expands the network’s reach. Consider a Nigerian agent who joined and referred his wife and brother-in-law, who are still agents to this day. In other countries, agents regularly refer their siblings and spouses as well.

- Self-perpetuating ecosystem: We often see agents marketing Accrue products, offering customer support within transactions, and even going as far as travelling to nearby countries to recruit new agents because the network’s success positively influences their finances. This level of investment creates a powerful positive feedback loop that accrues significant benefits to the network, including a high barrier against potential competitors.

The proof is in the pudding progress

Since our last progress update in June 2023, we’ve made much progress that bolstered our conviction and sharpened our focus on this thesis. A few of the most significant ones:

- By the end of 2024, Cashramp TPV will have grown ~809%.

- Monthly cross-border payments grew by ~488%. ~30% MoM since July 2024.

- Monthly Cashramp payments grew by ~138%.

- We’ve onboarded several active agents in South Africa, Côte d’Ivoire, Malawi, Rwanda, Tanzania, and Uganda, bringing our coverage to eleven (11) African countries, up from five (5).

- Cashramp’s API has helped several off-chain and onchain businesses like Opera’s MiniPay pay and get paid millions of dollars across eleven (11) African countries.

- We crossed 100k+ downloads on the Google Play Store.

Crypto is a game-changer; nowhere is that more true than in Africa. It continues to feel like the privilege of a lifetime to spend my time working with my co-founders and the kind, brilliant people at Accrue to make this thesis a reality.

Thanks to Timi Ajiboye and Aleph for reviewing drafts of this essay.