Can you believe it? We’ve been on this incredible journey for 1,077 days, helping over 200,000 of you manage your cross-border payments better. Every day has been an adventure, and we couldn’t be more grateful for your trust in us.

If someone had shown us a glimpse of what we’d go through building Accrue, we might have thought it wise to call it a day and kill the dream before we even began — just kidding, just kidding, we love it here 🤭

How It All Started

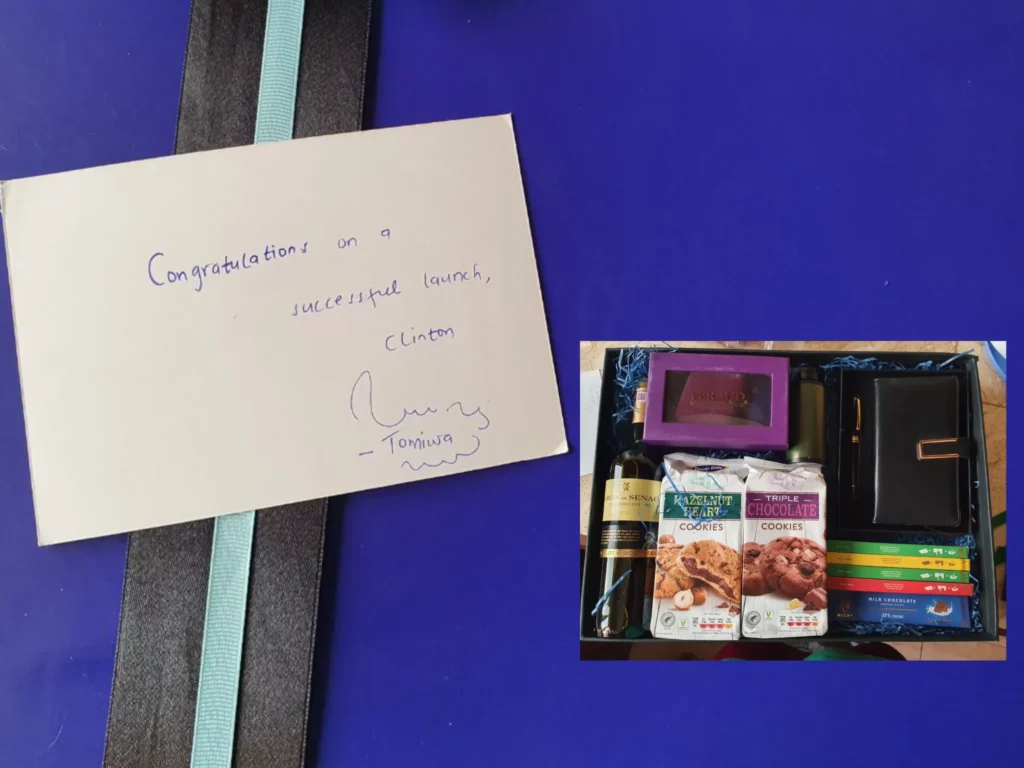

It all started with an idea—Zino wanted to build a dollar-cost averaging app to make investing in crypto and stocks simple for beginners. He shared it with Clinton and Adesuwa, who immediately got on board. The first validation came from Tomiwa, our former boss, who believed in us enough to write our first check. We’ll always be grateful for that early vote of confidence—thank you, Tomiwa!

We were like kids with a new toy, super excited about making investing simpler for everyone. We truly believed this idea would be something special, and with every small win, that belief only grew stronger.

Before we launched, over a thousand people had joined our waitlist, many flooding our mentions, asking for early access. Within three months, $100,000 had already been deposited into the app. Revenue started coming in, and for a while—during the crypto boom—everything felt like it was falling into place.

When we finally launched a private beta in late 2021, people loved our Dollar-Cost Averaging calculator. It was like having a financial advisor helping you visualize your looming riches. We could not have been more proud.

The Tough Times (Because Every Good Story Has Them)

Startups are emotional rollercoasters. In 2022, we hit our first major downturn when the crypto market crashed. Our once-promising revenue stream dried up as investor interest evaporated. Despite having a product people loved, raising funds became nearly impossible—investors kept turning us down, citing “poor market timing” even when they liked what we were building.

With our bank account dwindling and profitability nowhere in sight, we faced the harsh reality many startups dread: pivot or die.

Our first pivot didn’t work as well as we had hoped. Users would praise our app’s beautiful design and intuitive interface: “The Accrue app is so beautiful and easy to use, I just wish I had money to put in it.” While the validation felt good, we learned that a pretty product alone doesn’t make a sustainable business. Without growing revenue, we were not building a company. And that realization stung.

To keep the lights on while figuring out how to grow revenue, we went without pay for eight months, and we had to make some painful decisions, including temporarily laying off a valued teammate and cutting salaries by 35% for those who remained.

Finding Our North Star: Cashramp

Sometimes, the best ideas come from your users showing you what’s possible. On November 26, 2022 (we’ll never forget this day!), while checking our dashboard, we noticed a Ghanaian woman casually using our app to send money to her aunt in Nigeria in minutes. We were like, “Wait, what? It can do that?”

Cashramp! What started as a simple tool to help our Ghanaian users make deposits turned out to have incredible potential far beyond what we initially imagined. So we thought, “Let’s roll with this!”.

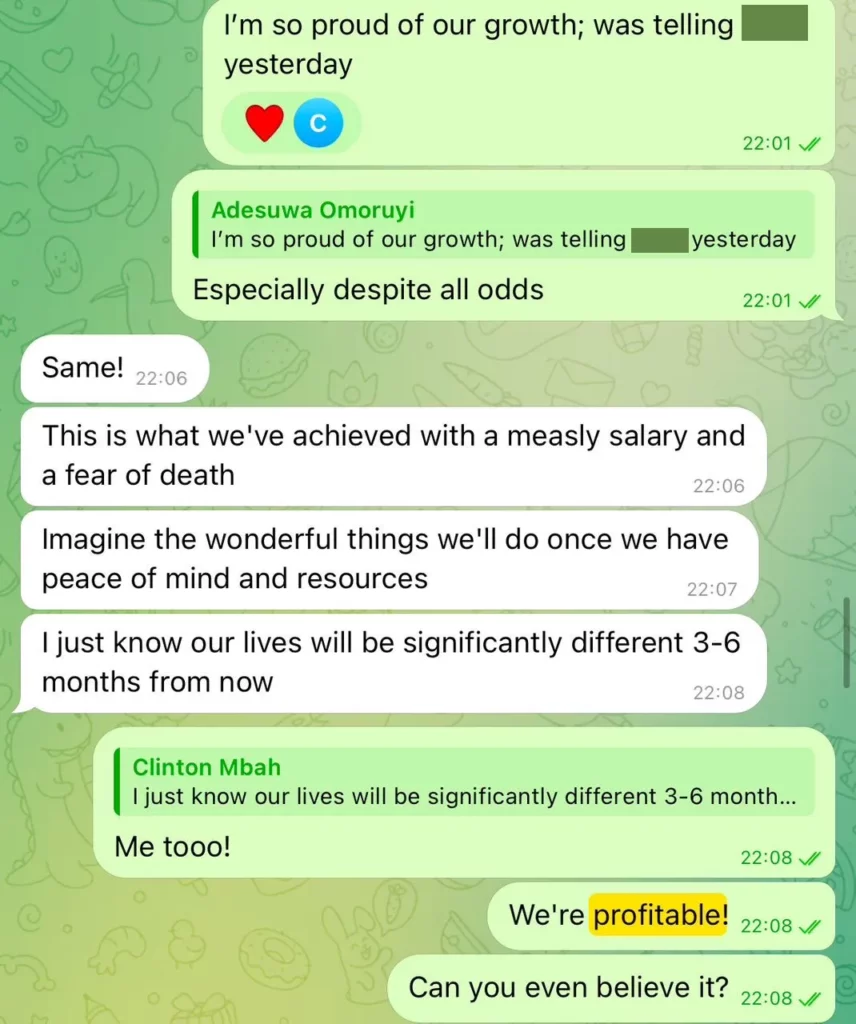

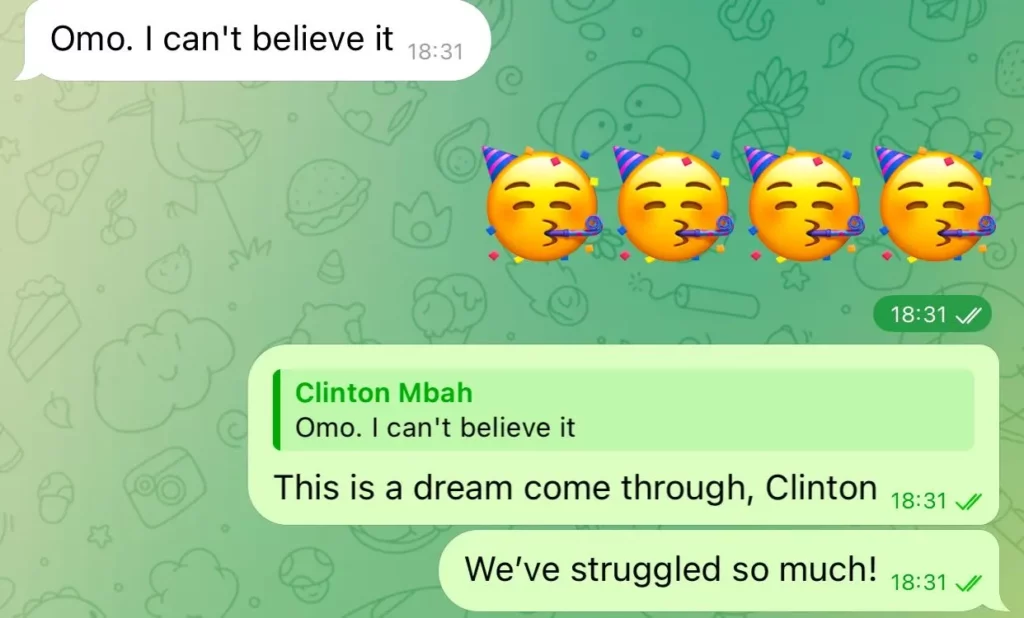

We pivoted the company again, this time betting everything on Cashramp (our cross-border payment infrastructure). And wow, what a ride it’s been! In just seven months, it went from being a tiny part of our business to bringing in most of our revenue. By mid-2023, we hit the sweetest milestone ever—profitability!

That night, we all slept like babies, knowing our business wasn’t just hanging on anymore; it was thriving. Talk about a plot twist in our startup story!

You have been our North Star through all of this. You told us exactly what you needed, and we listened hard – that’s why we’ve grown to include the Accrue Card, Virtual US bank accounts, and (coming super soon!) direct USD payouts. We’re just getting started! 💫

The Road Ahead (And Boy, Are We Excited!)

As we enter our fourth year, we’re filled with immense gratitude and excitement. What started as three dreamers with a vision has blossomed into a thriving company of 18 talented individuals, serving over 200,000 users across Africa.

None of this would have been possible without the incredible people who’ve been part of our journey. Our dedicated team, whose sacrifices and resilience have been the backbone of our success. Our Cashramp agents, working tirelessly around the clock to make seamless cross-border payments a reality for thousands of Africans. Our users, investors, and supporters, whose trust and feedback have guided every decision we’ve made. And to everyone who has engaged with us, whether through our products or social media—thank you for being part of our story.

To those dreaming of starting something new: yes, building a business is incredibly challenging. The uncertainty can be overwhelming at times, but that’s just part of the journey. What truly matters is taking that first step, learning as you go, and staying adaptable. Trust us—one day, you’ll look back and be amazed at how far you’ve come. Keep pushing forward; we’re rooting for you 💛

As we look to the future, we’re thrilled to announce our $1.58m seed round, led by Lattice Fund, with participation from Maven 11, Lava, Kraynos Capital, Distributed Capital, and other strategic angel investors. This investment will fuel our mission to expand our payment infrastructure across Africa, enhance our product offerings, and grow our talented team.

We’re building something truly special here, and you—our users, partners, and supporters—are at the heart of it all. Thank you for being part of this incredible journey. Here’s to many more years of growing together!

Happy 3rd Birthday to us 🥂

With love,

Clinton, Adesuwa & Zino

Co-founders, Accrue.