Nigeria’s financial technology sector continues to evolve, offering innovative solutions to help individuals and businesses manage their money effectively. Among the many players, Accrue and Cowrywise have emerged as prominent platforms, each with distinct strengths and a commitment to empowering users. While both share the overarching goal of fostering financial well-being, their core offerings and primary focus areas cater to different financial needs. Understanding these nuances is key to determining which platform, or combination thereof, is best suited for your financial journey.

Cowrywise: A Legacy of Disciplined Savings and Diversified Investments

Since its inception in 2017, Cowrywise has cemented its position as a leading wealth management platform in Nigeria. Its philosophy centers on cultivating a culture of disciplined saving and providing accessible pathways to diversified investments, primarily through mutual funds. Cowrywise has been instrumental in democratizing investment opportunities, making them available to a wider segment of the population.

Cowrywise’s Defining Features Include:

- Comprehensive Savings Plans: Cowrywise offers a variety of automated savings options designed to help users achieve specific financial goals. These include flexible savings, fixed savings for higher returns, and even specialized plans like “Halal Savings” for ethical investing. The platform encourages consistency through automated debits, making saving a seamless habit.

- Broad Mutual Fund Access: A cornerstone of Cowrywise’s offering is direct access to a wide range of mutual funds from reputable asset management firms in Nigeria. Users can invest in Naira and USD-denominated funds across various asset classes, including money market, fixed income, and equities, allowing for portfolio diversification tailored to individual risk appetites.

- Group Savings (“Circles”): This unique feature fosters a sense of community and accountability by enabling groups to save collaboratively towards shared objectives, such as rent, education, or travel.

- Intuitive Financial Planning Tools: The platform provides users with visual tools and insights to track their savings and investment performance, helping them stay on course and make informed decisions.

- Regulatory Assurance: Cowrywise operates under the regulation of the Securities and Exchange Commission (SEC) of Nigeria, ensuring a high level of security and compliance for user funds, which are held with licensed custodians.

Accrue: Specializing in Seamless Cross-Border Transactions and Dollar Preservation

Accrue, a more recent entrant, has rapidly distinguished itself by addressing critical gaps in cross-border payments and offering robust solutions for saving in US dollars. Its strategic evolution showcases an acute understanding of the challenges faced by individuals and businesses in an increasingly interconnected African and global economy.

Accrue’s Core Strengths Are Evident in:

- Efficient Cross-Border Payments: Accrue’s primary focus is on facilitating swift and cost-effective money transfers across various African countries and to the US. It supports transfers to bank accounts, mobile money services (e.g., MoMo, M-Pesa), and leverages an innovative agent network to ensure rapid payouts, often within minutes. This makes it an ideal choice for remittances and international business transactions.

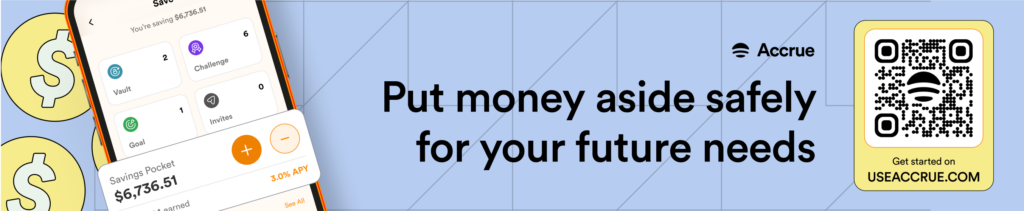

- Attractive Dollar Savings: In an environment of currency fluctuations, Accrue provides a compelling hedge by enabling users to save in US dollars and earn daily interest. This feature helps protect savings from local currency devaluation, offering a secure way to preserve and grow wealth. US earns up to 7% interest per annum and interest is paid daily.

- Virtual USD Cards for Global Spending: Accrue empowers users with virtual Mastercard/Visa dollar cards, simplifying international online purchases and subscriptions. This feature removes common barriers to global e-commerce, offering convenience and security.

- Diverse Funding and Withdrawal Options: The app offers multiple avenues for funding accounts, including local bank transfers, mobile money, M-Pesa, and stablecoins. Withdrawals are equally flexible, allowing users to move funds to local bank accounts or mobile money wallets quickly.

- User-Friendly Transfer Mechanisms: Features like “@crewtag” enable instant, fee-free transfers between Accrue users, while the “Deposit Link” simplifies receiving payments from anyone, even those not on the platform, by providing a shareable payment link.

Making Your Choice: A Synergistic Approach?

Both Accrue and Cowrywise are invaluable tools for financial empowerment in Nigeria, each excelling in its specialized domain.

If your financial journey prioritizes long-term wealth accumulation through diversified investments in mutual funds, alongside structured and disciplined savings plans, Cowrywise stands out as an established and regulated platform designed to guide you towards these objectives.

Conversely, if your immediate financial needs revolve around seamless and affordable cross-border money transfers, robust dollar savings to hedge against inflation, and convenient international online spending, and cross-border payment, Accrue offers a cutting-edge solution tailored to these specific requirements.

It’s also worth noting that these platforms are not mutually exclusive. For many, a synergistic approach might yield the most comprehensive financial strategy. You could leverage Cowrywise for your long-term investment portfolio and disciplined local currency savings, while simultaneously utilizing Accrue for efficient cross-border transactions and maintaining a resilient dollar-denominated savings cushion. Ultimately, the best choice depends on your unique financial goals and how each platform’s strengths align with your personal and business needs.

Accrue vs Cowrywise: Key Differentiators

| Feature | Accrue | Cowrywise |

| Primary Focus | Cross-border payments within Africa & the US, Dollar savings, Virtual USD cards | Savings plans, Mutual fund investments |

| Core Offering | International money transfers, USD savings with daily interest | Automated Naira savings, Access to diverse mutual funds |

| Main Currency for Savings | USD (with daily interest) | Naira & USD (mutual funds) |

| Investment Products | No direct investment products beyond dollar savings (as of current focus) | Wide range of Naira & USD mutual funds |

| Cross-Border Payments | “Savings Challenges” with the crew | No (primarily local focus for transactions) |

| Virtual Cards | Yes, Virtual USD Cards | No |

| Group Features | “Savings Challenges” with crew | “Circles” for group savings |

| Withdrawal Flexibility | Flexible for Dollar Savings Pocket, instant for transfers | Varies by plan (e.g., Emergency Plan is flexible, fixed plans are locked) |

MORE FROM ACCRUE

How to Earn Passive Income in Dollars

5 Fastest Ways to Pay Bills Online in Africa

How to Make Money From Your Hobbies