-

How to Shop from the US While Living in Africa (A Complete Guide)

There was a time when buying something from the United States while living in Africa felt like a privilege reserved for people with traveling uncles. You needed someone flying in from New York City, or a cousin returning from Houston, or a friend who could “help you buy and bring.” Today, whether you live in…

-

How Well Do You Know Africa? Only those who know Africa well will get 5/10 on this quiz. Can you?

AlexI’ve lived many lives, but one lesson ties them all together: money is only as powerful as its utility. Through my work, I share stories about money and create guides for Africans who want to get the best out of theirs.

-

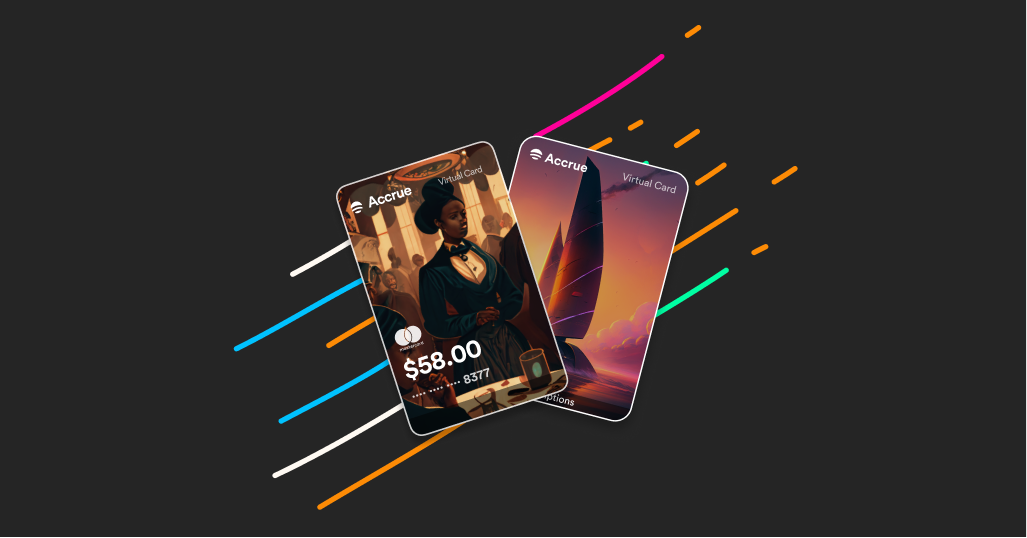

How to Shop Internationally With A Virtual Dollar Card (Step-by-Step Guide)

My friend Jake had spent time filling up his cart with bespoke clothes from Shein and some electronic accessories from Amazon. You know the feeling of finally checking out the things you have picked out, but then, when he clicked checkout, entered his card details on Shein and Amazon, and waited. “Payment declined.” He tried…

-

Hidden Fees Explained: How To Read A Money Transfer Quote

When Daniel, a Lagos-based fabrics dealer, sent $12,000 to his Ghanaian supplier for fabric, his bank charged a $60 wire transfer fee. He did the math, approved the transfer, and moved on. Two weeks later, his supplier called: only $11,540 had arrived. Where did the missing $400 go? Welcome to the jig-saw world of hidden…

-

How To Stop Fraud When Sending Money Abroad

Sending money internationally has never been easier. With a few taps on your phone, you can support family, pay suppliers, invest abroad, or handle emergencies across borders. At the same time, however, the rise of digital payments has created new opportunities for fraud. While reputable money transfer providers continue to strengthen their security systems, scammers…

-

How Faster Transfers Changed How These Families Plan

For years, my family planned our finances around irregular payments because the money took days to arrive due to “processing times,” and to create a buffer, extra money was sent. Then, the situation changed as transfers became faster and more reliable; something deeper changed. Families like mine didn’t just gain convenience; we gained control. We…

-

How Money Savvy Are You?

AlexI’ve lived many lives, but one lesson ties them all together: money is only as powerful as its utility. Through my work, I share stories about money and create guides for Africans who want to get the best out of theirs.

-

How To Have a Fun-Filled Valentine’s Day: A Single Person’s Guide

Celebrating Valentine’s Day as a single can be depressing, you know, because Valentine’s Day is that magical time of the year when couples suddenly do nothing but act lovey-dovey. If you’re single, this day can feel like a personal attack, but hear me out: Valentine’s Day as a single person can actually be fun after…

-

Love on a Budget: How To Celebrate Valentine’s Day Without Going Broke

The moment gift box vendors start flooding your timeline with red ribbons, teddy bears, and “last-last discount,” just know Valentine’s Day is knocking aggressively. We can argue later about why an ancient saint’s death is now responsible for emptying our bank accounts. For now, let’s focus on the real issue: how to avoid being labeled…