When news broke recently that Paga had integrated PayPal, it was seen as an expansion and inclusion of the country into the global economy. With the rise of freelancing, remote work, e-commerce, and the creator economy, access to dollar payments has become more important than ever.

However, instead of excitement, the announcement was met with widespread backlash online. For many Nigerians, PayPal represented years of restrictions, frozen accounts, high fees, and limited functionality. While the Paga–PayPal integration technically brings PayPal back into the conversation, many users are asking a simple question: does this actually make things better?

The Longstanding Issues with PayPal

PayPal’s challenges in Nigeria are not new. Many users associate the platform with sudden account limitations, frozen balances, inconsistent support, and policies that feel unclear or unpredictable.

The Paga integration does not eliminate these issues. It simply places another platform in between. While this may help some users access their money, it does not address the core problems of cost, control, and reliability.

How PayPal Works in Nigeria Today

With the new integration, Nigerians can now receive PayPal payments through Paga and withdraw the funds into their local bank accounts. This means it adds more steps to an already complicated process. Users are moving money from PayPal to Paga before finally accessing it locally. Along the way, they encounter PayPal’s transaction fees, currency conversion losses, and limited control over their funds.

For freelancers and remote workers earning in dollars, these costs add up quickly. What should be a direct and efficient payment flow ends up feeling like a workaround rather than a permanent solution.

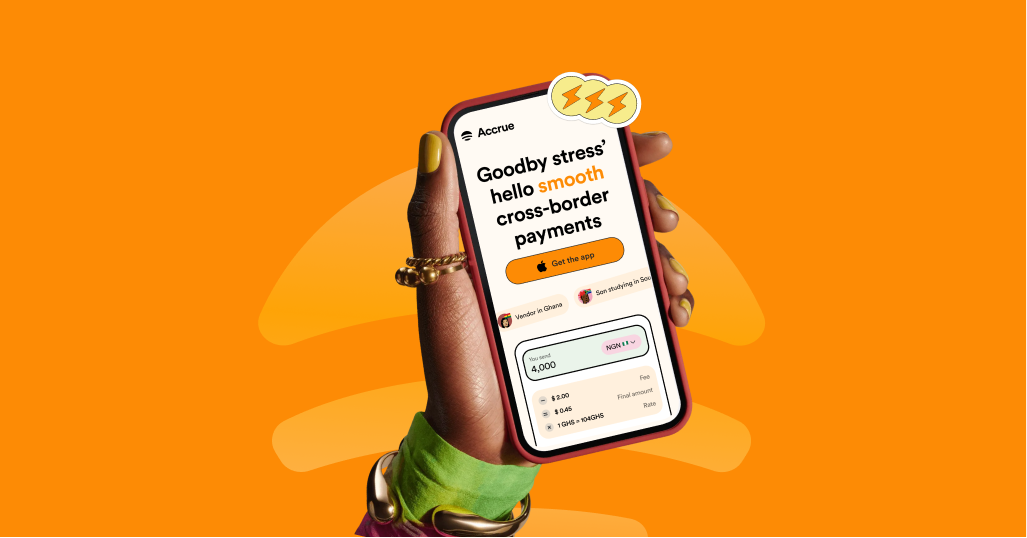

What Does Accrue Do Differently?

Accrue was built specifically for Africans who send, receive, and manage money around Africa and the US. Instead of retrofitting global platforms to local realities, Accrue focuses on direct access and simplicity.

With Accrue, users can open a dollar account in minutes and receive international payments directly, without routing funds through multiple platforms. Everything happens in one place, making it easier to track, manage, and access funds when needed.

Accrue also provides virtual USD cards, allowing users to pay for global subscriptions, online tools, ads, and services without relying on third-party workarounds.

For people earning in dollars and spending in local currency, this creates a smooth, seamless experience.

Transparent Fees and Better Exchange Rates

One of the most common complaints about PayPal is cost. Transaction fees and unfavourable exchange rates often reduce the actual amount users receive. Adding Paga into the flow does little to improve this reality.

Accrue’s withdrawal fee is $2. The fees are clearly communicated, and users know exactly what they’re getting. Over time, especially for consistent earners, these fees become insignificant.

Trust, Control, and User Experience

Trust is everything in financial services. Many Nigerians remain cautious about PayPal because of past experiences with frozen accounts and limited support.

Accrue has earned user confidence by focusing on reliability and consistency. The platform is designed to give users more control over their money, fewer surprises, and faster access, key factors for anyone depending on foreign payments.

So, Which Option Makes More Sense?

The Paga–PayPal integration represents progress, but it does not fully solve the challenges Nigerians face when using PayPal. Costs remain high, control is limited, and the process is more complex than it needs to be.

Accrue aligns more closely with how Nigerians earn and move money today.

Create a dollar account in your name and start enjoying transparent pricing and tools designed specifically for African users. Accrue remains the best option for managing dollar payments in Nigeria.

I’ve lived many lives, but one lesson ties them all together: money is only as powerful as its utility. Through my work, I share stories about money and create guides for Africans who want to get the best out of theirs.